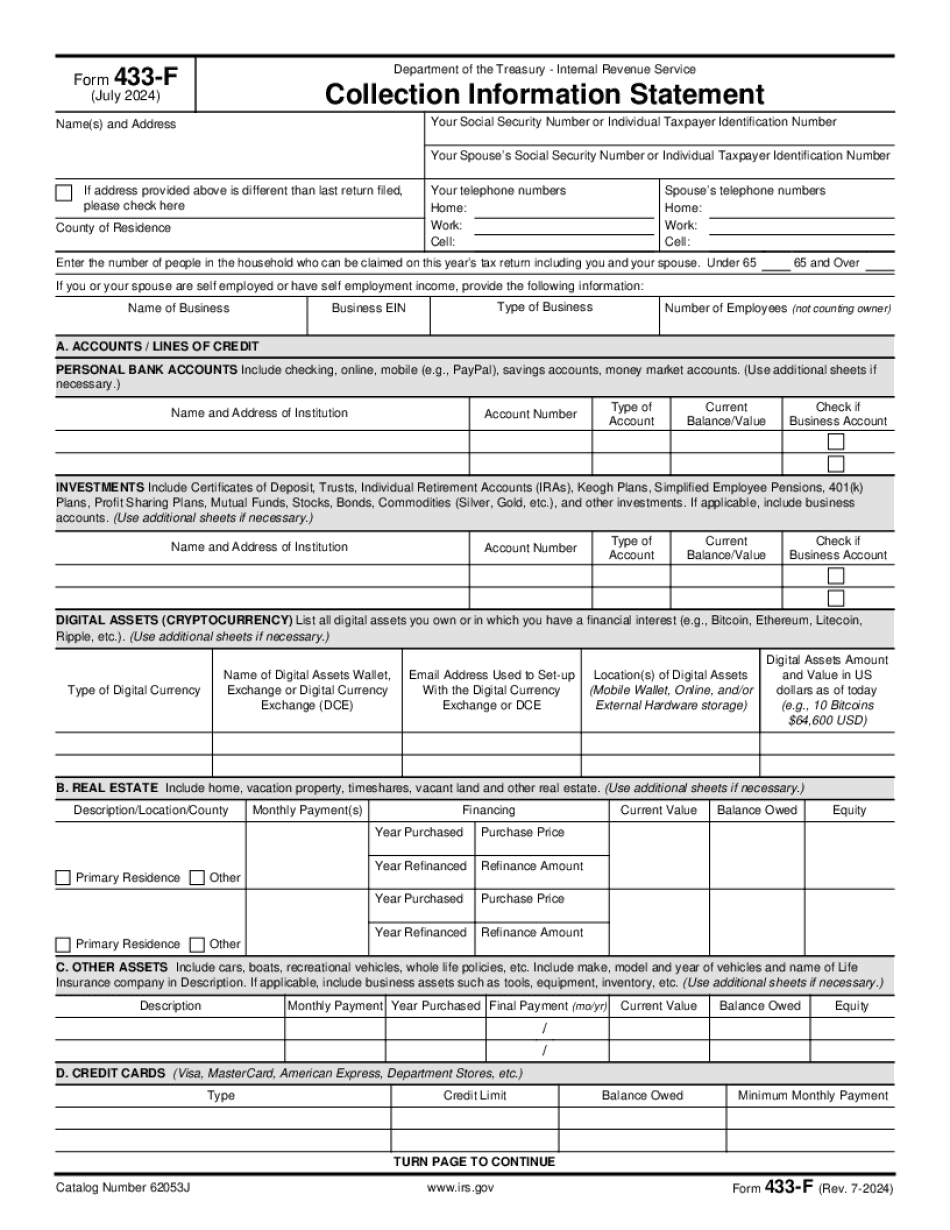

The two main reasons why taxpayers lose against the IRS are lack of preparation and using ill-advised procedures. The goal here at Tax Help is to get you prepared for the least cost. We will guide you while you gather the necessary documents and complete the forms. This makes the cost vastly less expensive and only you can get the documents because you know where they are and have the permission to get them. In IRS collection efforts, you will be required to complete a Form 433-F or a Form 433-A for individuals, or a Form 433-B for businesses. Pages 5 & 6 of the Form 433-A are used for self-employed individuals. Because these forms require a lot of work, we have designed webinars for you to watch so you can prepare these forms for your maximum benefit. If you owe the IRS less than $25,000, please use Form 433-F. If you owe the IRS greater than $25,000, please use Form 433-A. If you own a business or are self-employed, we have combined Form 433-A and Form 433-B for a discount on both. After you complete these forms and have gathered all your evidence, please call us so we can review everything and design a specific action plan for your benefit. Thanks and we'll look forward to hearing from you.

Award-winning PDF software

Irs 433 F mailing address Form: What You Should Know

If you do not have a mailing address associated with the IRS, you need to send the form by mail to the IRS on the address for the address in the instructions (PDF). IRS Form 433-F: Payment-Type Return. The location you send IRS Form 433-F is dependent upon the location of your mailing address to report Form 433-F. The IRS considers this form a payment-type return for payment types. However, if the IRS cannot verify any information for a Form 433-F because of a privacy exemption for a return that was filed on an electronic filing system, we may use your information to complete your return using another form provided to you by the IRS. It is the responsibility of the recipient to ensure all information provided to the IRS is correct. For information related to using Forms 433-F for payment types and income, see Forms 433-F: Payment Types and Income Form 433-F, Payment Types and Information About Return, Publication 915 (PDF). (If you have not already submitted IRS Form 433-F, refer to the following IRS resources to see whether you require a payment-type return.) IRS Form 433-F, Payment Types and Information about Return, Publication 915. Inst 4: IRS Form 433-F Application for Credit IRS Form 433-F Application for Credit IRS Form 433-F, Federal Tax and Trade Bureau, Electronic Return Application, Electronic Reply. Inst 4, IRS Form 433-F, Application for Credit. IRS Form 433-F, Electronic Return Application. IRS Form 433-F, Electronic Reply: IRS Electronic Response Filing System (ERAS). Inst 4: IRS Form 433-F Application for Credit. This return is not due until the next filing year, and does not include an estimated tax payment. IRS Form 433-F, Estimated Tax Payment, Electronic Return Application, ENTRAP. IRS Form 433-F, Estimated Tax Payment. IRS Form 433-F, Estimated Tax Payments. Inst 4, IRS Form 433-F, Application for Credit.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 433-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 433-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 433-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 433-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 433 F mailing address