PDF editing your way

Complete or edit your irs form 433 f anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 433 f directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 433f as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs form 433f by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 433-F

What Is Irs Form 433 F?

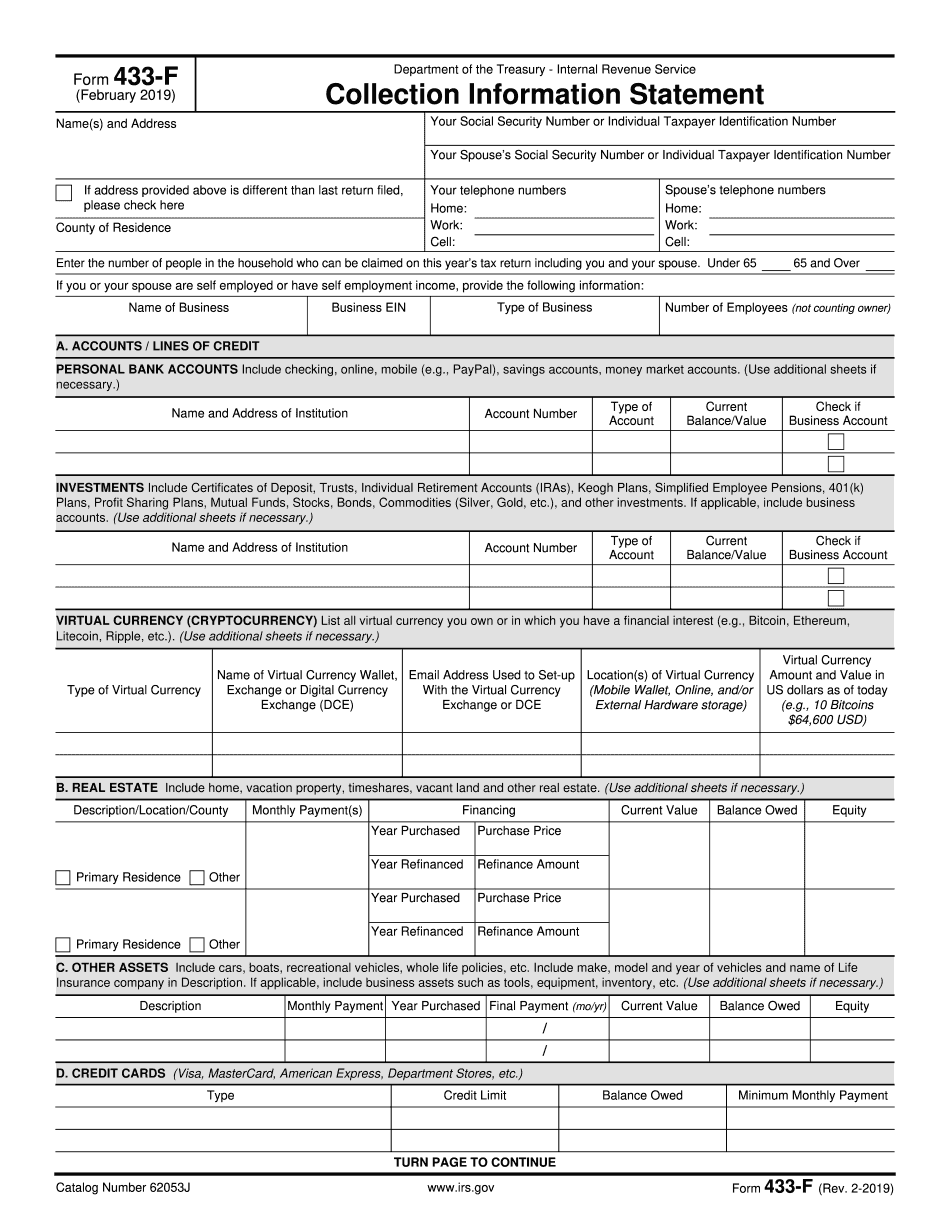

The form 433-F is also known as Collection Information Statement. It is usually used to collect financial data form the individuals with delinquent tax debt. If you owe the Internal Revenue Service money, you are provided with this document in order to determine how you can repay your arrears. Then IRS can define your eligibility for payment plans.

You may also use the form 433-F to apply for uncollectible status. The IRS doesn’t make completing this document easy for you. However, you may facilitate the process by using online services with fillable templates. Read the following instruction to fill out the template correctly.

This paper is divided into 8 section, each of which requires your close attention. Look through the list of data to include:

- Your bank accounts and lines of credits, IRA, profit sharing plans, mutual funds, bonds, and related accounts;

- Any property you own including your primary residence, vacation homes, rental properties, and even timeshares (including the reason of purchasing, price, current value and equity);

- Details about other assets you own (cars, boats, RV’s or whole life insurance)

- Business information;

- All your credit cards;

- Employment information (how much you get paid and what gets taken out for taxes)

- Additional earning (alimony, child support, unemployment payments);

- Amount you spend each month;

Note, that it is necessary to sign the document that is also possible to perform online.

Online answers make it easier to organize your doc management and increase the efficiency of your workflow. Comply with the quick guideline with the intention to total Form 433-F, stay clear of faults and furnish it inside of a timely manner:

How to complete a Form 433 F?

- On the web site together with the variety, click Start off Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your individual information and facts and contact info.

- Make positive which you enter appropriate material and numbers in correct fields.

- Carefully look at the material of the type at the same time as grammar and spelling.

- Refer to assist portion for people with any queries or handle our Guidance group.

- Put an digital signature on your own Form 433-F with all the guide of Signal Resource.

- Once the shape is finished, press Accomplished.

- Distribute the ready kind by way of e-mail or fax, print it out or conserve on your own unit.

PDF editor will allow you to make adjustments in your Form 433-F from any online related product, personalize it as outlined by your requirements, indication it electronically and distribute in several methods.