Award-winning PDF software

Aurora Colorado online Form 433-F: What You Should Know

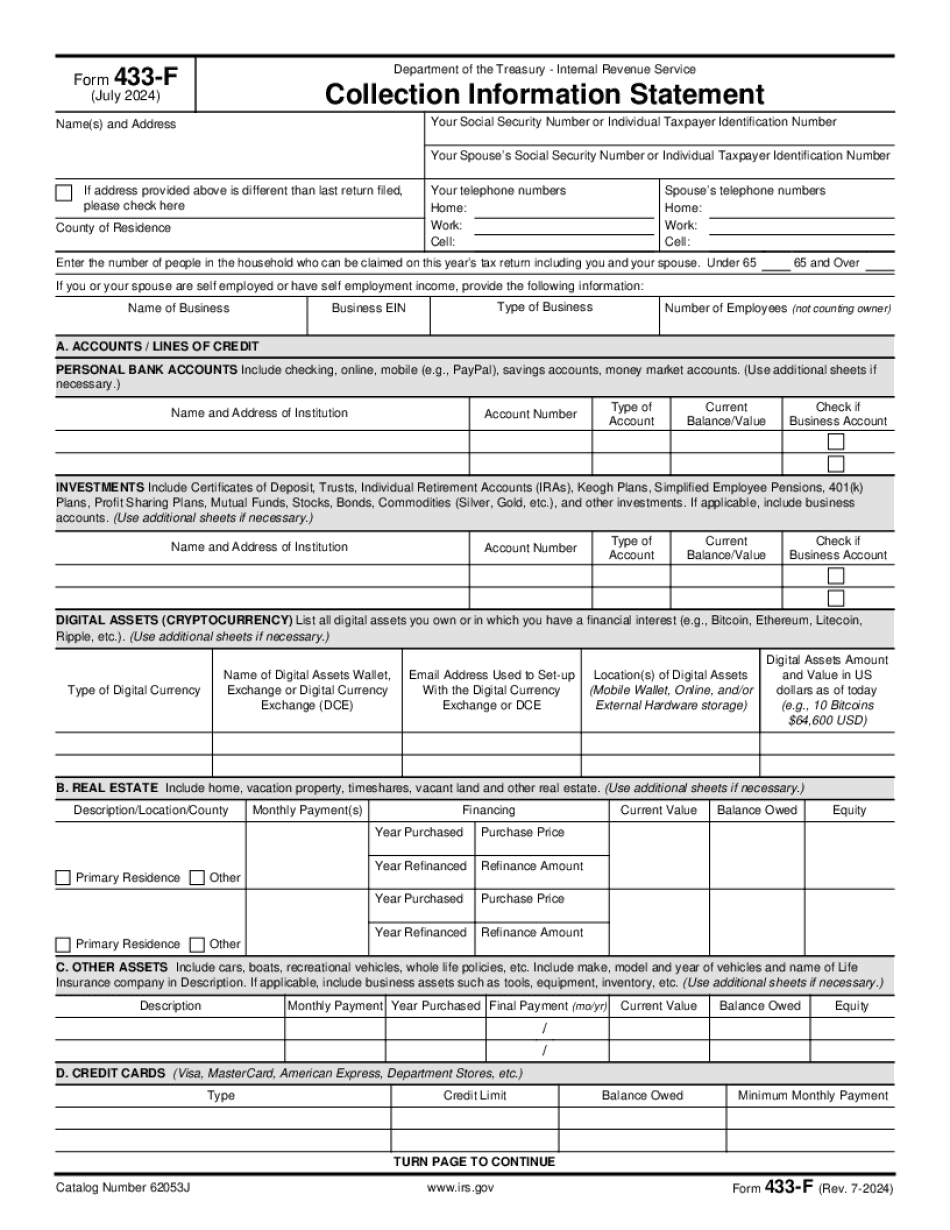

What is “collective bargaining”? What is the difference between an organization and a group? How much information do I need to provide when sending in a Form 433F for approval. When & how to use this form for payment plans and CNC status with the IRS. What has the IRS done? Where can I search for guidance for my issue? What other services will the IRS have available to me? What forms do I need for an IRS Form 433F? IRS Forms 433F: Collection Information Statement (Collection Information Statement) and Form 540: Notice to Pay, are two documents the IRS sends to wage earners (e.g., individuals, organizations, or joint employers) in the State(s) of Colorado to request proof of employment so that the Wage Earner and/or self-employed person may make tax payments. These two forms were issued on a “request-for-evidence” basis to provide wage earners and self-employed persons in the State of Colorado an individualized, non-arbitrary, time-limited avenue through which to make tax payments. A Form 540 is a written notice to pay that is prepared for publication in the Colorado Tax Bulletin and mailed to taxpayers. Both forms serve to provide wage earners and self-employed persons with the following benefits: Individualized payment options — Wage earners and/or self-employed persons will be notified in writing within 120 days after the due date of Form 433F or 540 to allow the wage earners and/or self-employed persons to make a payment in lieu of the form. If the taxpayer doesn't make the payment or doesn't pay the full amount by the due date, the wage earners and/or self-employed persons may submit the correct amount by the due date. Notice to Pay — If the wage earners and/or self-employed persons do not respond to the written notice, the employer on which they are working may begin the process to collect the withholding due with the IRS. Notice to Provide — If the wage earners and/or self-employed persons responded to a tax mailing, the notice will be sent in a timely fashion to avoid the wage earner and/or self-employed person's tax liability while awaiting payment of an amount due. Forms 433F and 540 are time-limited (120 days) and may be requested at any time by the taxpayer or wage earners and/or self-employed persons.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado online Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.