Award-winning PDF software

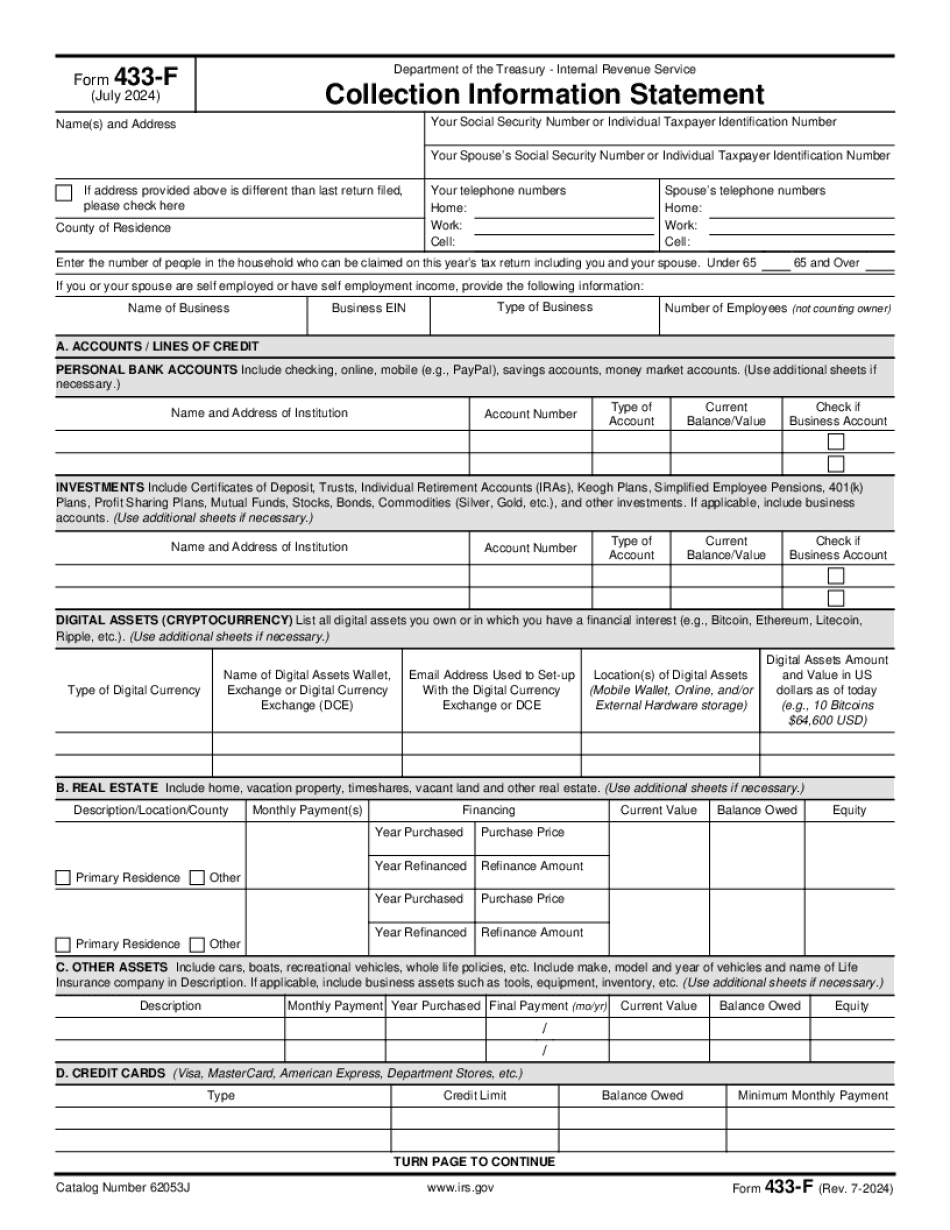

Form 433-F Corpus Christi Texas: What You Should Know

The value is based on the property as it may exist in the future. Description. A description of the property that is suitable for the taxpayer. TAX ID NO. Status Permit Sum Issued Date Application Type. Owner. Qualified Individual. Qualified Residential. Qualitative Classification. Qualified Residential. The taxpayer meets one of the following qualifications. Qualified individual. The taxpayer is engaged in the provision of home support services as defined in section 1015(a) of the United States Code. Qualified Individual. The tax filer is engaged in the provision of home support services as defined in section 1014 of the United States Code. Qualified Residential. The property is in the possession or control of an eligible organization of individuals or an eligible entity that satisfies the following requirements. (1) The taxpayer receives a qualifying disability, including, but not limited to, being treated as having a qualifying disability by someone who is licensed, certified, or otherwise qualified by law to represent the United States as a qualified individual; (2) A disability (other than being treated as having a qualifying disability by someone who is licensed, certified, or otherwise qualified by law to represent the United States) imposed by, or resulting from the treatment of the taxpayer in connection with, pregnancy or birth of the taxpayer or dependent children of the taxpayer or being related by blood or marriage to a taxpayer or dependent children of the taxpayer; or (3) A serious or substantial physical impairment which does not substantially limit one major function. The tax filer satisfies one of the following requirements. TAX ID NO Status Permit Sum Issued Date Application Type. Qualified Residential Qualitative Classification. Qualified Residential. Qualified Residential. The tax filer qualifies or meets all the following criteria to be a Qualified Residential: 1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-F Corpus Christi Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-F Corpus Christi Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-F Corpus Christi Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-F Corpus Christi Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.