Award-winning PDF software

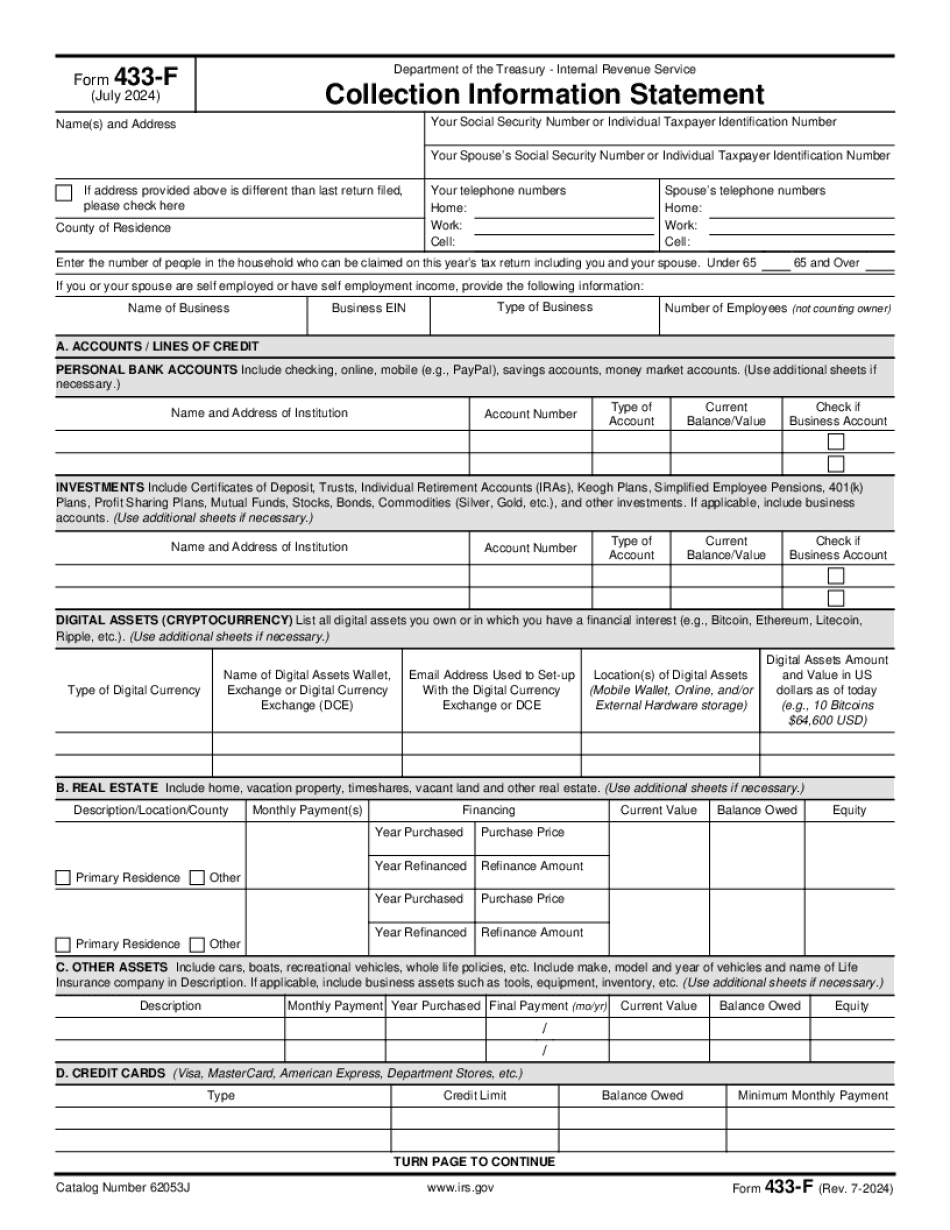

Form 433-F Indianapolis Indiana: What You Should Know

IRS 433-F — Is the first form to be submitted for a tax period, therefore the information being requested in the form is generally the same for all taxpayers during all periods. IRS Form 433 F. — In conjunction with information from your IRS 433 F — Is a standard form and is accepted by all tax agencies in the United States. IRS 433-F — Filing for the first time will be required. Form 429 — The IRS Form 429 is used to report income or loss from a business or from rental, sale, or exchange of property on Form 1040 or 1040A. You may, if you wish, itemize the deductions on this form rather than file separately. The Form 429 may also be utilized by your trade or business to comply with federal tax regulations regarding withholding. IRS Form 431 — This tax form is used for tax withholding from income or capital gains. When the form is used to report tax withholding, an Additional Child Tax Credit, and the Alternative Minimum Tax (AMT), tax is calculated on the employee's wages. IRS Form 521 — This form is used to deduct employee premiums and co-pays. The Form 521 may be filed by one person for one employee. IRS Form 523 — This tax form is used to deduct employee premiums and co-pays. The Form 523 must be filed by one person for one employee if he or she provides a filing account. IRS Form 528 — If you are self-employed, your gross profit on property or services over 600 is tax-free whether it is purchased by the self-employed individual on your own premises, or by the self-employed individual with a partner, in a partnership, or with a business, through an agent. IRS Form 535 — If you are self-employed, you are entitled to take an employer contribution for your business expenses, even though you received your first payment after you went into your business. IRS Form 607 — This IRS form is used to file Form 5471(E) if you are self-employed, and you will be able to deduct up to 600 of business expenses. IRS Form 7006 — This IRS form must be filed if you are self-employed, or you will be self-employed in the future, and you will be able to deduct self-employment tax on up to 600 of business expenses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-F Indianapolis Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-F Indianapolis Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-F Indianapolis Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-F Indianapolis Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.