Award-winning PDF software

Form 433-F online Fort Wayne Indiana: What You Should Know

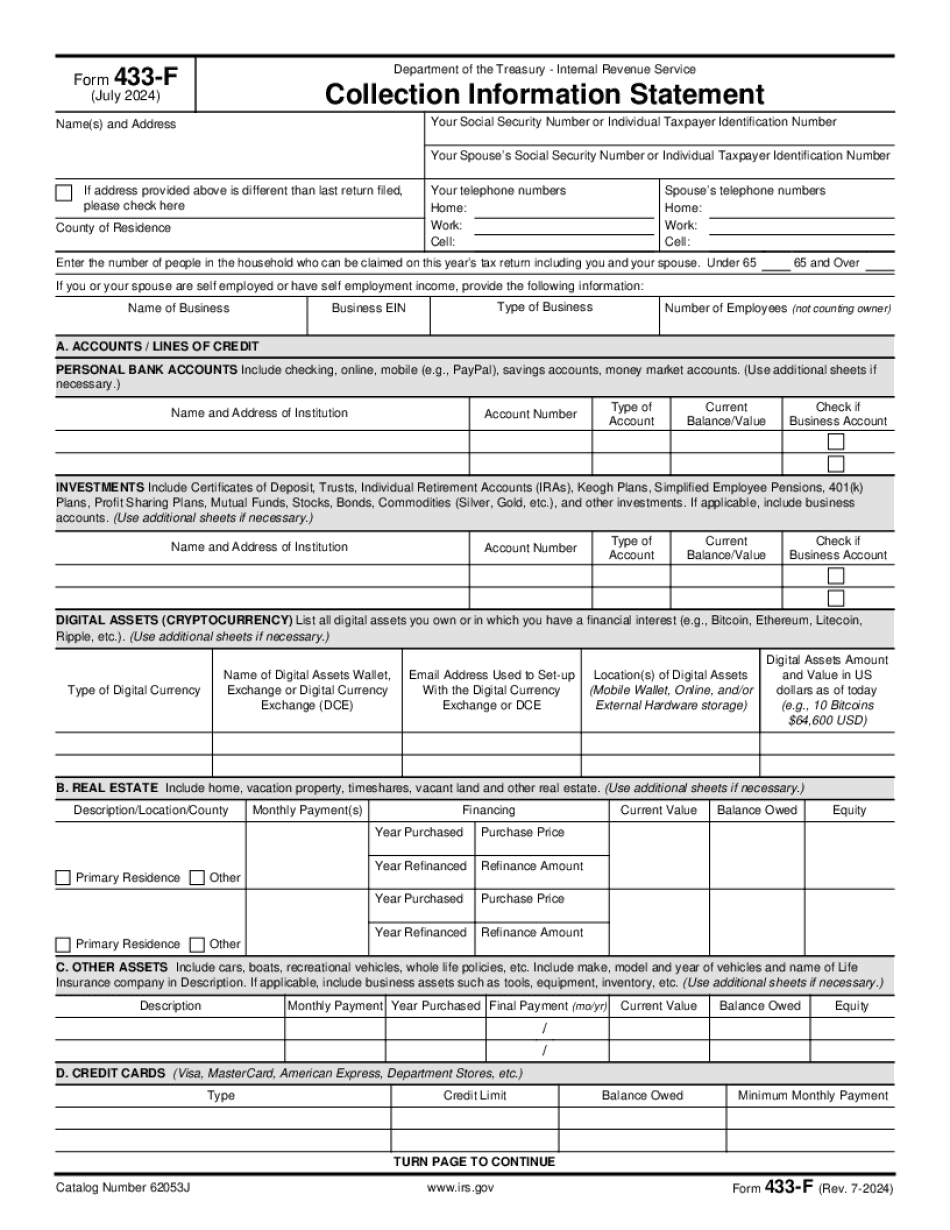

Form 433-F? Form 433-F: Collection Information Statement — IRS. When To File. If you or your spouse or child files a tax return (IRD Form 6013, etc.) that does not pay all or part of your tax debt within 15 days of the due date, you must file Form 433-F. Do it now. (If you have filed prior to March 31, 2001, you will need a statement form 433-F-1.) Do not wait till you are a legal adult. You will not be able to qualify for any type of refund or offset, including a credit or credit toward tax-related penalties or interest, if you wait till you become a legal adult. Form 433-F Is For Households With Dependent Children (This should not include lone filers or individuals with small income.) The “collect” or account number is on the back of the form 433F (Collection Information Statement). The IRS sends the IRS address and phone number at the bottom, and you will receive a certified e-mail with instructions to file the form. (The agent will e-mail you to the e-mail account you have with him or her to complete the form, but this form works for most people.) Note: You have to pay the delinquent taxes to avoid a tax lien. The filing fee for 433-F is 12.00 per child, as specified in the Form 433-F instructions. (For example: 34.10 for a 6-year-old with 1 child.) The IRS collects the delinquent tax, makes a credit for child tax credits in most cases (based on the child's earnings), and sends a notice to the obliged (in the form of e-mail). IRS Form 430/530: Payment Plans for Tax Refunds. IRS Form 430 and IRS Form 530: Payment Plans for Tax Refunds. The purpose of the two forms is to allow you to make a partial payment to reduce or cancel the tax debt, while the interest and penalties do not apply. Both forms need to be completed. IRS Form 430 and IRS Form 530: Payment Plan for Tax Refunds — What is the difference between Form 430 and Form 530? Both forms are extensions of the payment deadline. Form 430 is for delinquent taxes and Form 530 is for tax refunds.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-F online Fort Wayne Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-F online Fort Wayne Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-F online Fort Wayne Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-F online Fort Wayne Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.