Award-winning PDF software

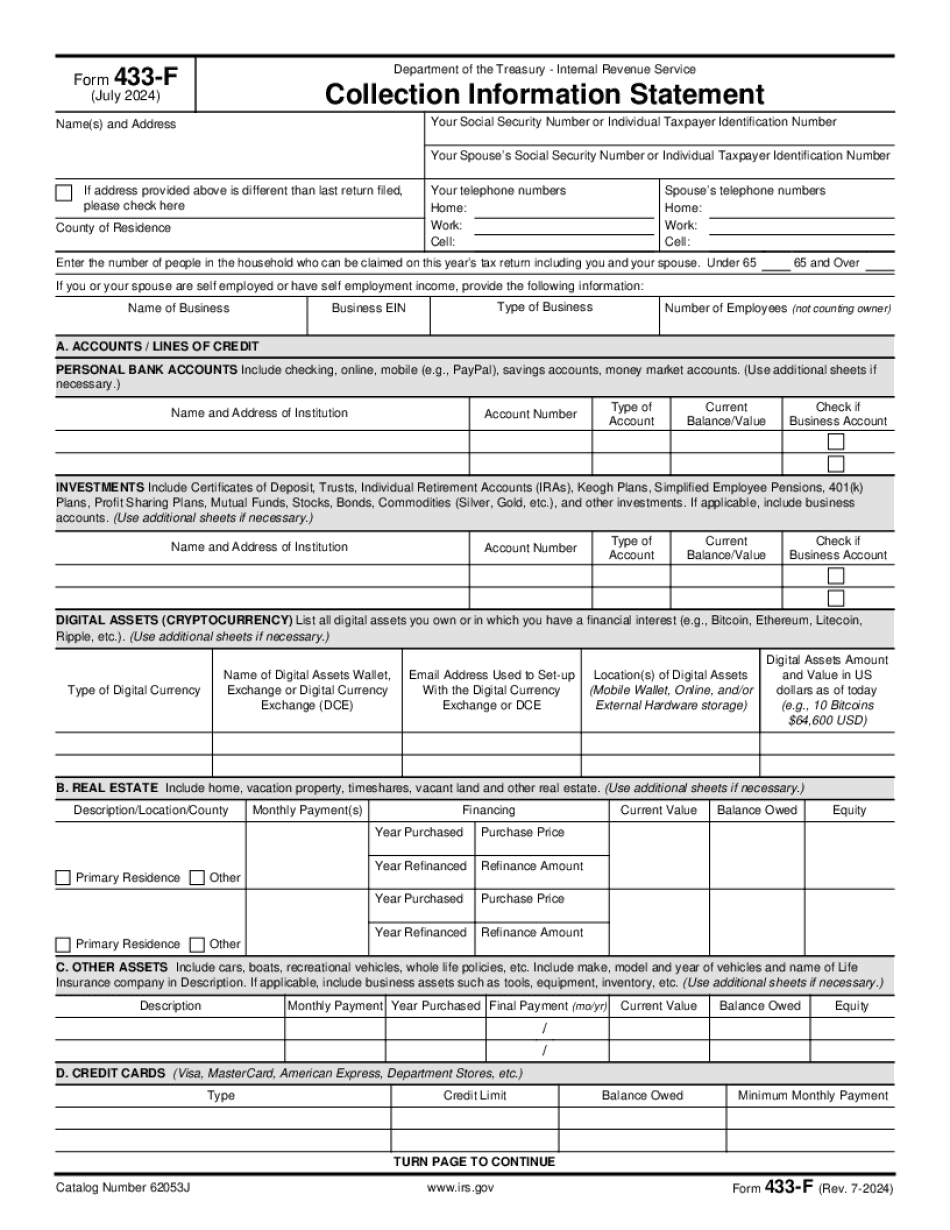

Form 433-F online Gresham Oregon: What You Should Know

The Federal Wage and Hour Administrator (FWA) has guidelines for the payment plans that a nonprofit or tax-exempt organization may employ. The guidelines are available in the online form FSM-1 (PDF) at (RSA forms). The Form 433-F (IRS Form 433-F) application must state whether the organization is an “employer operating as a tax-exempt organization” (EOC). If the EOC is an employer operating as a tax-exempt organization, the payment plan should specifically include reimbursement of certain types of eligible expenses, such as payroll taxes and worker training expenses. Also, under the guidelines for OCS, an EOC may reimburse any eligible non-reimburseable costs, such as travel, employee supplies, etc., if the total amounts paid by the applicant for the costs do not exceed the least of 50 or 15% of the applicant's gross receipts or 50,000 as of the date of application, whichever is greater. Any employee with a minimum qualifying salary must be compensated at the rate of 14.50 per hour or the first 25,000 in remuneration, whichever is greater, for working hours performed. Additional instructions and guidelines for applying for a payment plan and CNC status with the IRS can be found in “Employee Assistance Program” Flyer at CALEB Compliance Notice IRS Criminal Investigation (CI) Training Information — Taxpayer Assistance Center The Taxpayer Assistance Center (TAC) is a free service that offers the opportunity to obtain a copy of the tax practitioner's information for the purpose of filing an income tax return, requesting a return or claim, or asking for a tax advice. TAC is located in all Federal Crown Agencies (FCA) including but not limited to the Canada Revenue Agency (CRA) and Provincial Treasury Entities. It is accessible through Canada Post and Postal Service. It includes phone numbers that are answered in English and Spanish, as well as online ordering capabilities (if in Canada, telephone ordering is also available). Contact Information: Federal Crown Agencies The Taxpayer Assistance Center is open Monday to Friday, 9:00 a.m. to 4:30 p.m. for all tax years (October to March).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-F online Gresham Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-F online Gresham Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-F online Gresham Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-F online Gresham Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.