Award-winning PDF software

Norwalk California online Form 433-F: What You Should Know

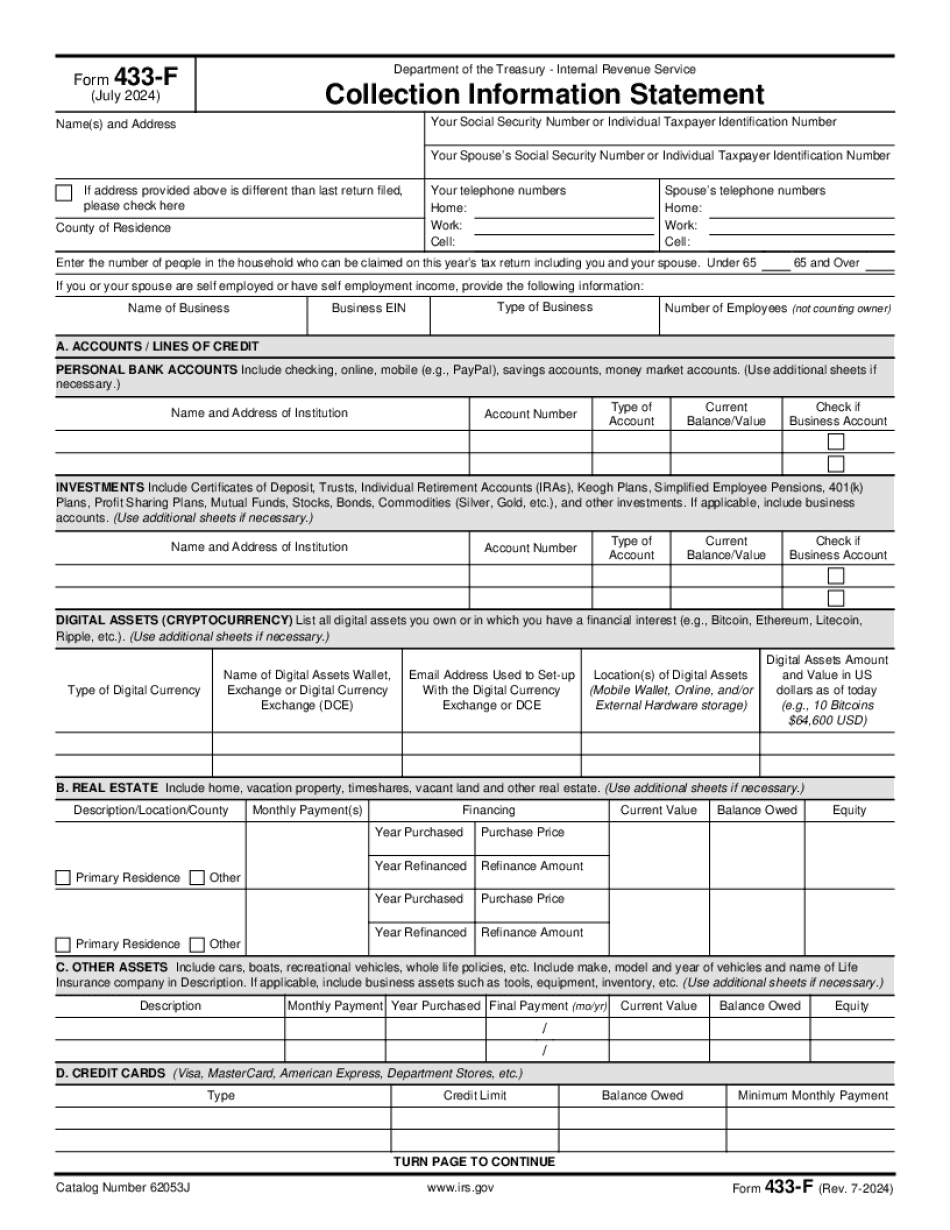

The California Department of Finance and Administrative Services provides the following information to taxpayers on page 13 for forms 433-F & 433-H, both available at the taxpayer website. (a) The purpose of the CCL is to provide the California Department of Finance with a comprehensive overview of the California financial information. It provides the department with statistics concerning all financial transactions including the amount of sales tax, fees, fines and penalties owed by the taxpayer. The information on CCL is also available for the counties, town or city where the taxpayer resides. The California State Board of Equalization, which regulates the collection of property taxes and assesses the rates and amounts to be charged, maintains detailed records showing the income and wealth of every taxpayer on this website. California is a community property state (Cal. Coast. Art. IV, §9, & Art. XIV, §11), which makes it permissible for all property to be subject to taxation, thus creating a property-tax system. California's Property Taxes According to the California Supreme Court (CIV. R. 34, 558), the taxation of real property is a public power, and in cases where a party or individual has no physical or legal possession or enjoyment of the property under the circumstances of the taxation, the property cannot be taxed. However, where the party or individual has physical possession or enjoyment, or is in possession or enjoyment in the same manner as the taxpayer, and the property is taxable, the court held that the taxation is a public power. In United States v. Tripoli, the court held that the United States' right to tax its sovereign soil, for example, a road, or a parcel of land could not be limited by the taxpayer's possession of the land. California is different and has a taxing interest in all property. Property must be assessed for assessment based on its true value. Formal assessment of the assessor must be made by all taxing agencies. As a practical matter, this means that the assessor makes an assessment of every property for taxation. The assessment is the statement of the value of the property. A taxpayer who is unable to come to an agreement with the assessor, or who is not satisfied with the amount of assessment, could file a timely objection, but may be disqualified from receiving a refund if the tax is contested. The assessment form and any accompanying statements are filed with the county clerk's office. The county clerk publishes the form and accompanying statement monthly.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Norwalk California online Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a Norwalk California online Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Norwalk California online Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Norwalk California online Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.