Award-winning PDF software

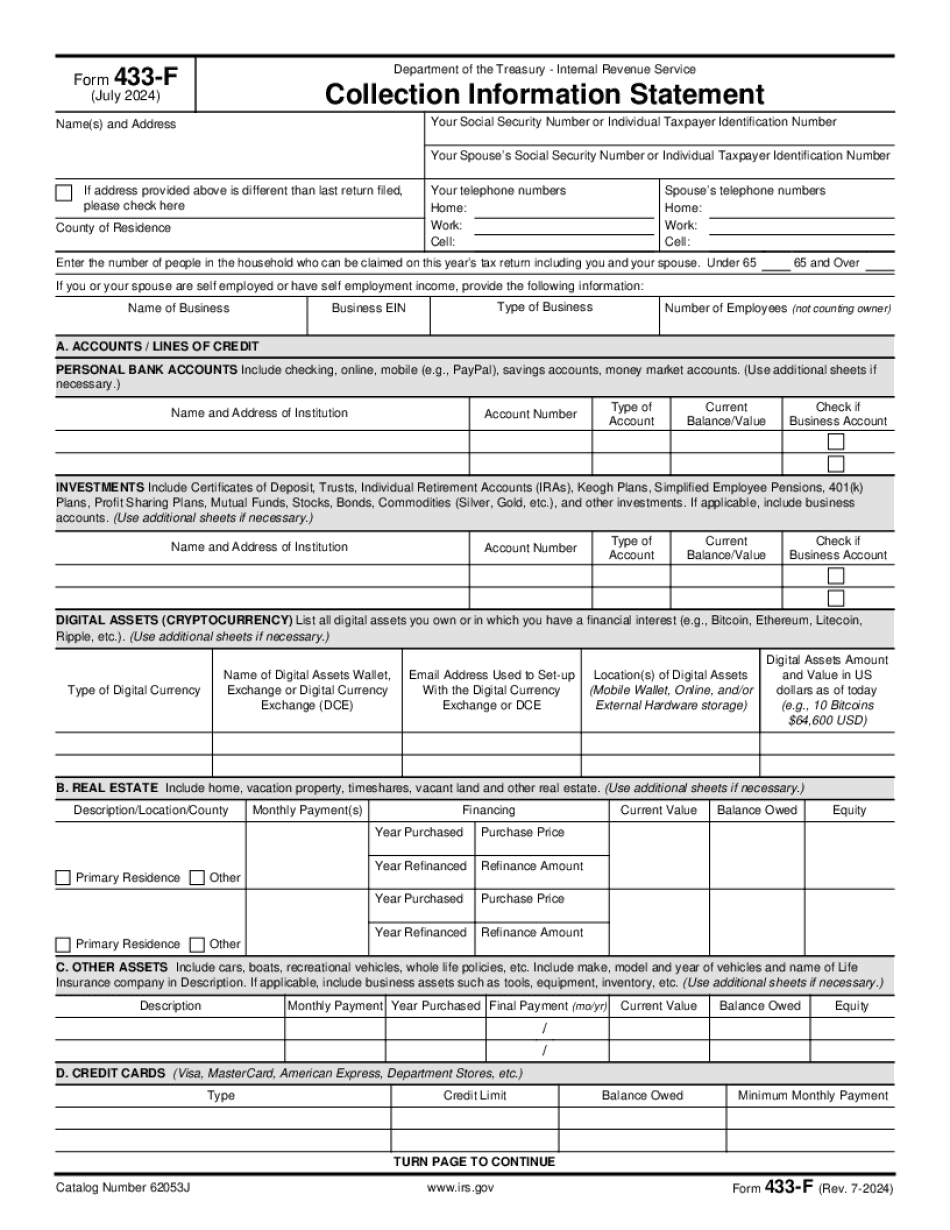

Printable Form 433-F Mesquite Texas: What You Should Know

The IRS form 433-F “F” is designed to establish the information needed for you to obtain and verify income information for you and your dependents. It also includes an information section for you to provide information regarding employment or self-employment income in your city. The form can be modified to help you fill out the forms if it is not the same as what you already have to fill out. When you submit the forms, make sure that you use an online payment system to pay for Forms 8700 and 8708 (see this page for instructions). Form 433-F F. Non-Wage Household Income. (List monthly amounts. The IRS may establish a payment agreement for you based on the financial data you provide on this form. Federal law requires every person and business operating a business or doing business in the United States to withhold federal income tax from each dollar they earn in federal taxable transactions. As described in Sec. 6758(b)-4(C), each taxpayer who is required to withhold income tax from net earnings from self-employment taxable sources must electronically file Form 8881 and include the required information on Form 8881 that identifies the federal income tax with which he/she is liable to withhold and pay. Form 8881 This paper form was developed for taxpayers who had to file Form 8888 and did not have computers in place to process the paper forms. The IRS used this electronic system to issue Form 8888. As stated on page 3 of the information provided by the taxpayer on the IRS Form 8888 Form, to apply for Form 8881 the taxpayer's computer needs must have been used to download, print, sign, and/or scan all the required information. The electronic filing system is designed to enable taxpayers to complete all the required papers and to get them into one location. To assist you, we've created this page to assist you in completing the required paper forms and to receive the required forms electronically. The paper form template is a PDF file you may use to make any necessary modifications to the form. However, the PDF forms will have the same basic information that is on the form electronically. Information on the Forms 8881. This is NOT a payment plan form for the IRS Form 8889. Do not pay 20 or more. These payee names do not appear at IRS.gov. These are government entities with which you are not dealing with the same individuals who collect your income taxes through the 990.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 433-F Mesquite Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 433-F Mesquite Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 433-F Mesquite Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 433-F Mesquite Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.