Award-winning PDF software

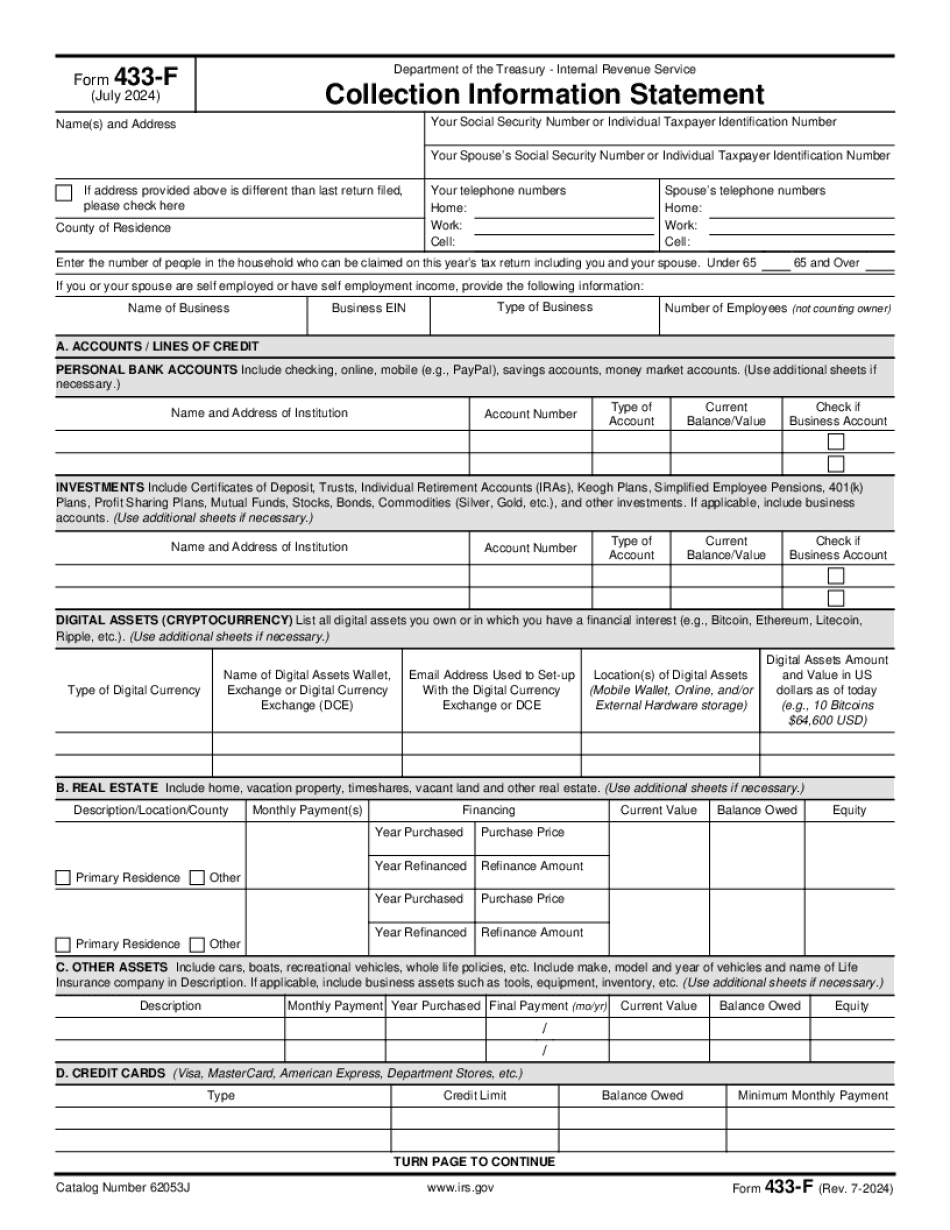

Rochester New York Form 433-F: What You Should Know

Filing and service of summons or complaint — Form 433-T — New York State Department of Taxation The forms 433 and 436 are the forms the IRS uses to collect delinquent tax debts. If your property has been seized and you Filing and service of summons or complaint: Form 433-T (Notice of Property seizure) is the form the IRS uses to issue a summons to someone who owes taxes. It is issued to the person owning the property when the IRS has determined that the property belongs to the taxpayer. If the property is a commercial vehicle, the summons has a mandatory stay for ten years. If the property is a residential unit or a business, the summons may be served the next tax filing due date. If a person owes the IRS money for property or services that he or she previously provided, tax law allows the government to impose a tax lien. The government can take possession and use of the property until the amount owed to the tax agency and interest are paid (Form 433-T, Notice of Property seizure). The next tax filing due date If a person owes the IRS money for property that may have been used to avoid payment of the tax, the government can require the government to pay back the debtor's interest for the time period that it took to collect the owed money. The debtor can request that the IRS pay back his interest, in which case the debtor should file Form 709, Request for Federal Tax Payment (Form 709-A, Request for Refund), with the tax agency when the taxes are due. Form 2340-A, Debt To Pay, and Form 715, Request for Federal Tax Payment, are two notices that a debtor can send to the IRS, asking the IRS to pay the total tax due. Form 433-T is also called notice of property seizure or a Notice of Tax Evasion. On this form, a tax collecting agent requires you to describe and list any property that may have been used for purposes other than legal ones. The tax agent also requires information about the debtor's wages, personal property, and the amount that the debtor owes. The debtor is required to enter the amount owed on the form. The IRS may be able to use this information as evidence that you are in arrears.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Rochester New York Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a Rochester New York Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Rochester New York Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Rochester New York Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.