Award-winning PDF software

Form 433-F Texas Collin: What You Should Know

These forms are updated annually. You can obtain the documents required by your county by following these instructions COLLIN COUNTY, TEXAS. COLLIN COUNTY, TEXAS The Management's Discussion and Analysis of Financial Information (MD AFI) is required by the Internal Revenue Service for non-farm business entities in counties of 10,000 to 12,000 people. The MD AFI is a document that should be filed with your county tax collector every two years. The MD AFI shows that the County is in good health and has not experienced any changes in the income statement, cash balances, loans, etc. in the last two years. You will have the option of either completing a Form 333-L for the MD AFI or completing an MD AFI supplement form. All of these forms must be completed by November 30 of the calendar year in which the MD AFI is due. You should complete Form 334-L. For more information, visit Please read the following instructions carefully before completing the form. The information provided in these instructions should never be used to make a false claim to the IRS and this information must not be cited later in court. The filing of the form is not a legal requirement, just a way to show you satisfied the County's current requirement regarding the MD AFI and to get a check from the County for any amounts due. After you complete this form and send it with the check, you must file a tax return for the month in which the MD AFI is due, which is not necessarily the month you file the form. You may file for the MD AFI in a different state then where the County office is. The county is not responsible for the time it takes to obtain and apply forms. It will take at least two weeks to process your payment. The payment may be received by the County within 2 weeks of the due date or in some cases more, depending upon the volume of transactions. In lieu of using the form template below, you may use the forms from the County online, and by phone, fax or mail to the office that handles the form. The TX County Tax Collision Center is an agency of the Tax Collision Center and is responsible for gathering, processing, and filing TX County non-employee income tax returns, including the annual report.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-F Texas Collin, keep away from glitches and furnish it inside a timely method:

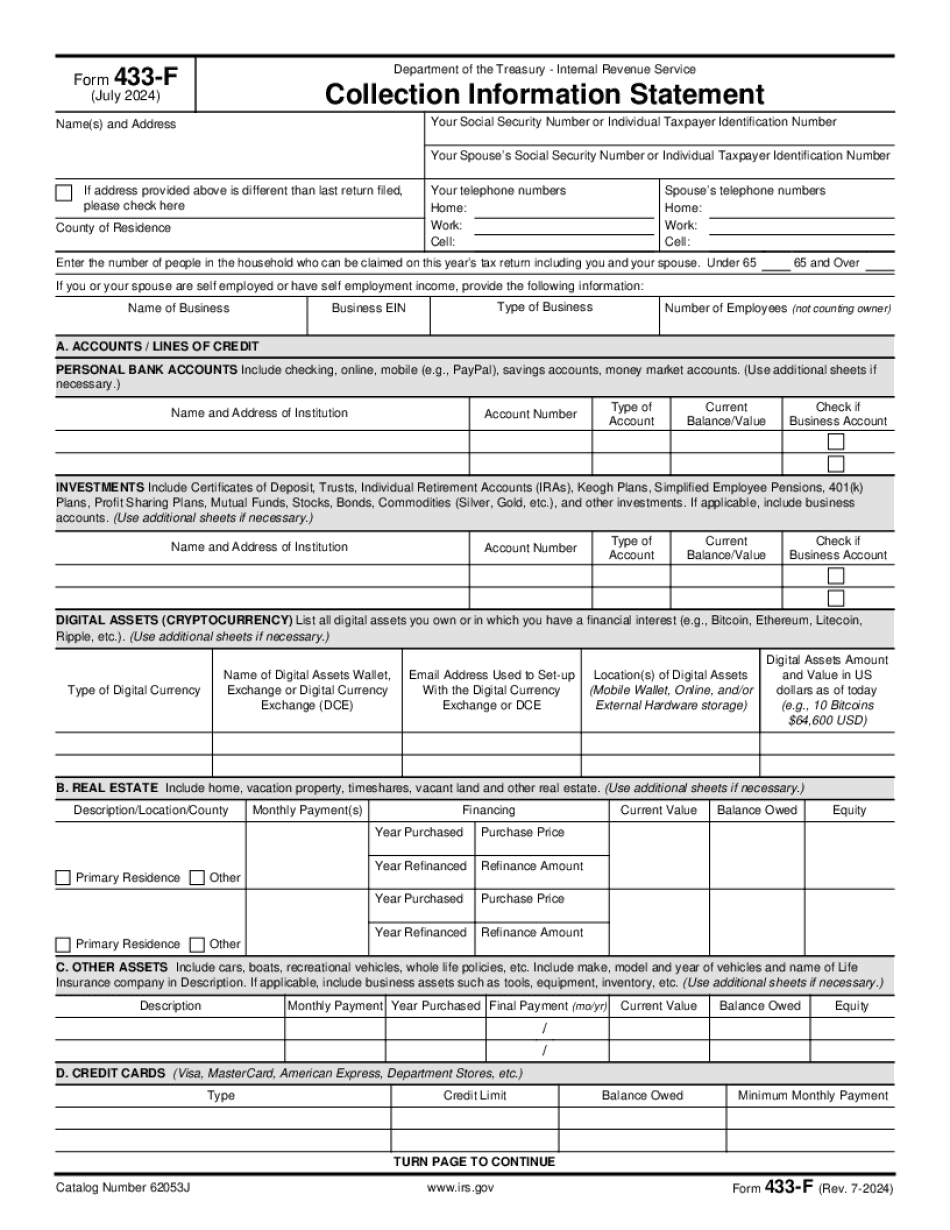

How to complete a Form 433-F Texas Collin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-F Texas Collin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-F Texas Collin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.