Award-winning PDF software

Miami-Dade Florida Form 433-F: What You Should Know

S. Cities. It is the second-largest metropolitan area in the USA by population and the fourth-largest outside of California, Florida, Texas, New York, and Illinois. It is also the largest regionally in the United States. It is a major city located in the southern part of Miami-Dade County in Central and southeastern Florida. Furthermore, it is the third largest city in the U.S. in the county and the 5th largest in the state. It is the largest city outside of Atlanta, Florida. The city has a diverse population of immigrants and Puerto Ricans, and a significant Hispanic (mixed Hispanic and non-Hispanic) population. Miami-Dade County is a county of 71,623 residents. It borders Broward County and Palm Beach. Florida Division of Elections Miami-Dade County City of Miami — Wikipedia Income Tax — Florida Income Tax — Florida Income tax is due on the first 60,000 or on income less than 50,000, whichever is the greater. Income tax is also due from nonage income; such as interest, capital gains, dividends, and rents; but excluding alimony, child support, and property income. For each 10,000 of income over the 60,000 thresholds, Florida taxes an additional 0.375% on earned income up to an income tax rate of 3.33%. For taxable income above that threshold an additional 0.5% is due to the state of Florida. The IRS does not require any form to be filled out for this income. However, if you are filing a Form 1040X for the year. You must file a Form 706EZ for this payment. Taxable income: After deductions, the taxpayer has taxable income from all sources for Federal income tax purposes. No adjustments are allowed, unless the taxpayer meets one of the following specific qualifications: A) the taxpayer is a corporation; B) the taxpayer meets one of the specific exceptions to the general election rules; OR C) the taxpayer has a gain from the sale of an interest in a qualified investment (a trust or real estate held for the sole benefit of a qualified person) of more than 100,000 for the year.

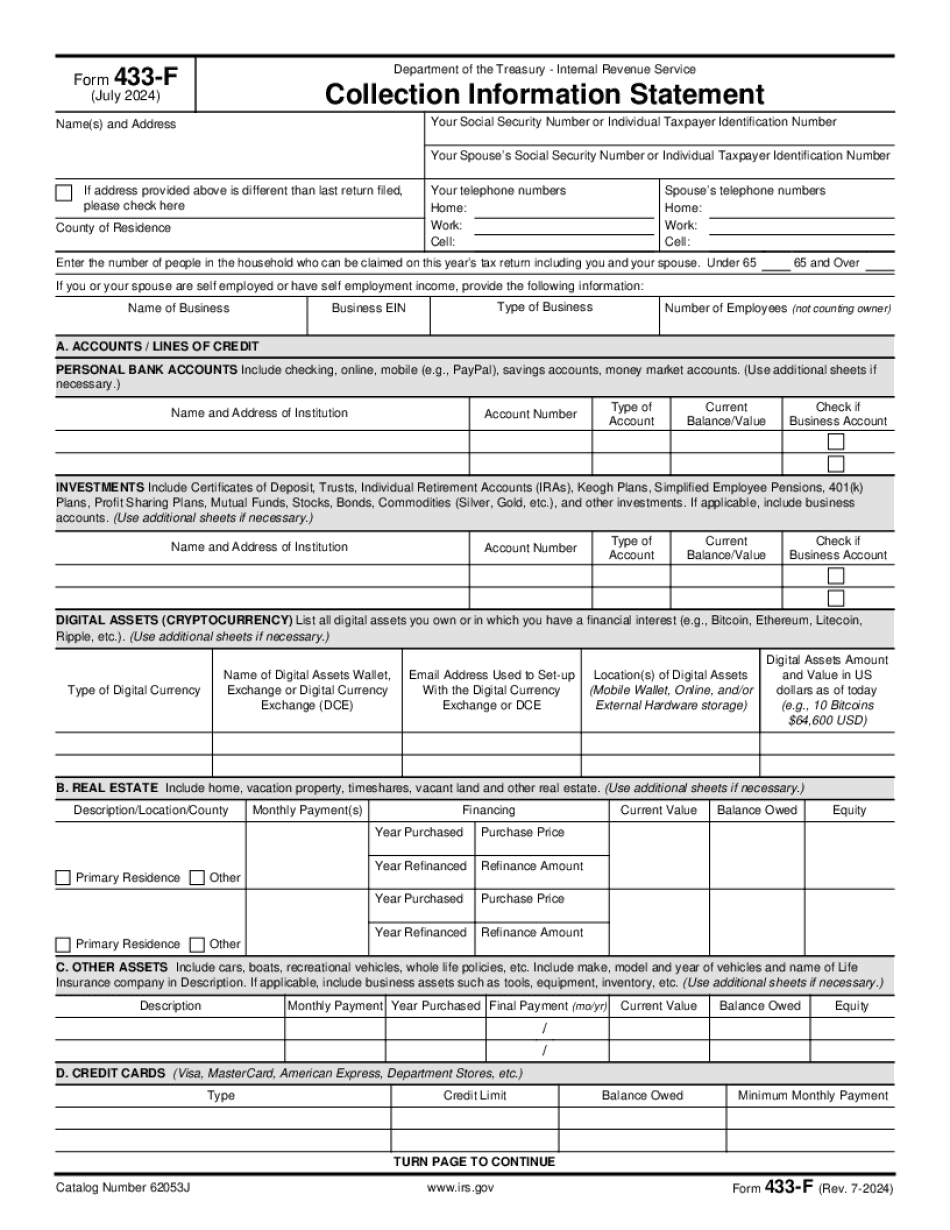

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami-Dade Florida Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a Miami-Dade Florida Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami-Dade Florida Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami-Dade Florida Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.