Award-winning PDF software

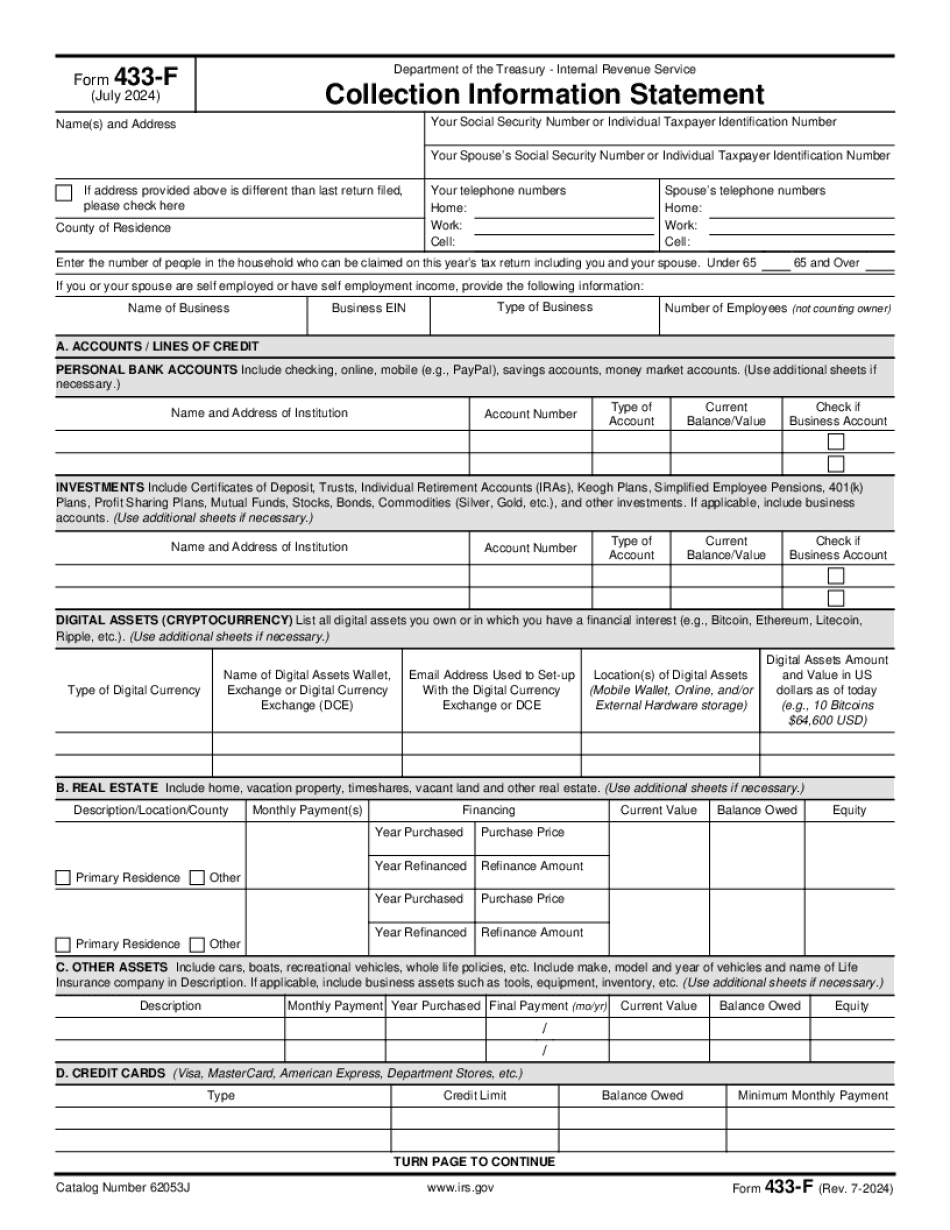

Form 433-F Texas: What You Should Know

If you owe tax, you've got options. If you don't want to pay and are interested in resolving the issue with the Tax Court, you should seek a referral to the agency's Taxpayer Advocate Service. You can find that service as an option on IRS.gov or by calling. Don't ignore the debt. You owe the tax. If you do not pay the tax when due, this could subject you to criminal prosecution. What are the options you have? You have options! If you do not want to pay and are interested in resolving the issue with the Tax Court, you should seek a referral to the agency's Taxpayer Advocate Service. You can find that service as an option on IRS.gov or by calling. The Department of Justice (at IRS.gov) handles tax-related criminal and tax delinquency matters and offers the following resources: Tax Counseling/Auditing Tax Counseling and Auditing (TCA) offers a variety of free tax preparation and payment options to taxpayers and taxpayers' representatives. The TCA Program uses information from public and private tax filings and other resources in an effort to improve the fairness and accuracy of the IRS tax system. This program provides a number of free assistance services: Tax Counseling: CTA has many free tax prep services available to taxpayers. Tax preparation: CTA offers tax preparation services. Payment plans: Available to individuals and businesses who do not have access to another program (CRA). The IRS Taxpayer Advocate Service: When taxpayers or taxpayers' representatives have a question, we can help. What is Tax Counseling? Criminal matters are criminal cases involving federal taxation and criminal convictions. Tax Counseling includes the services of attorneys who can review tax returns, advise taxpayers of their options for resolving a tax matter and provide information on state and local criminal and tax matters. CTA employees are knowledgeable about these matters and can provide tax advice and assistance to taxpayers. The services of tax professionals are provided for free by the Department of Justice during normal business hours.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-F Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-F Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-F Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-F Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.