Award-winning PDF software

New Mexico Form 433-F: What You Should Know

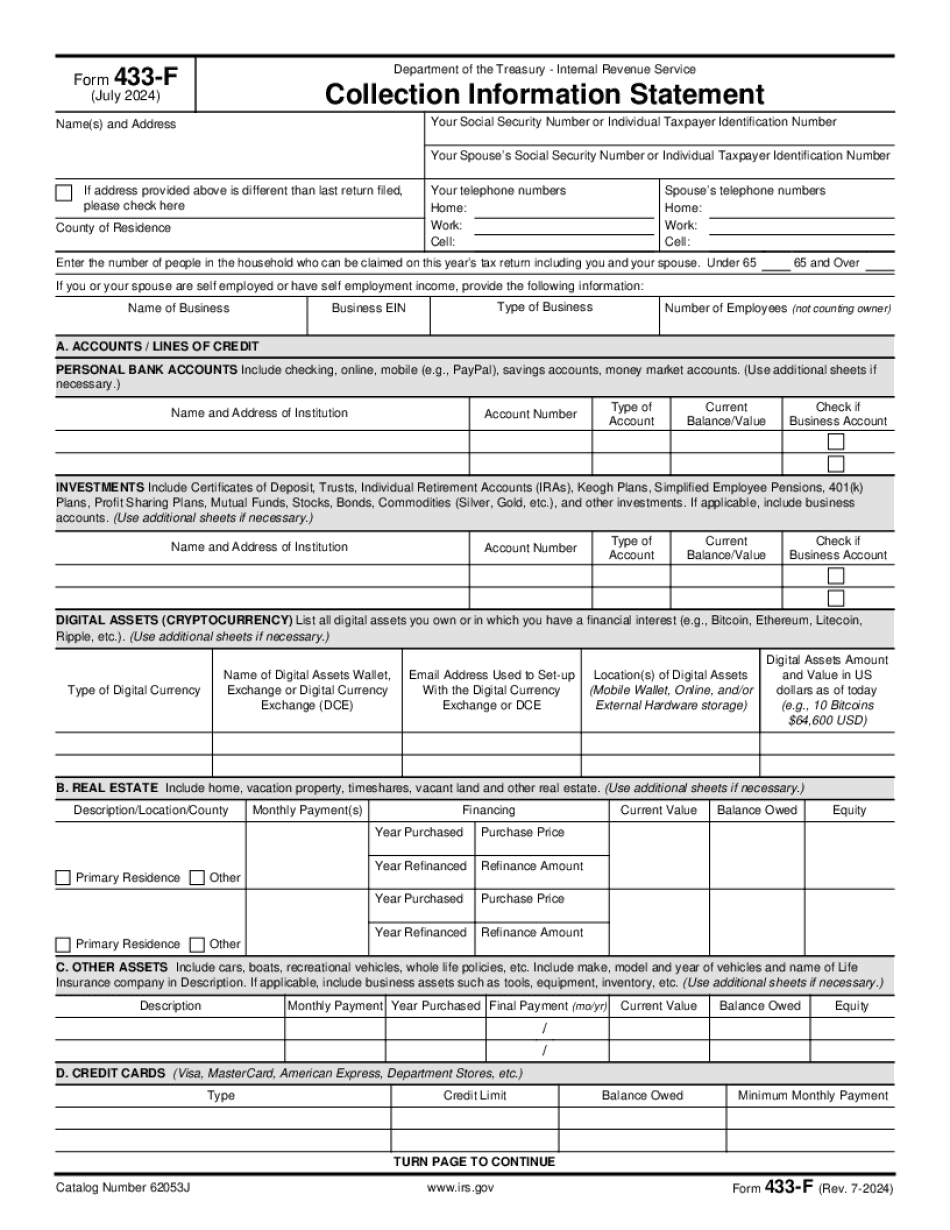

Forms & Publications: IRS Form 433-F Welcome to the IRS website, We're excited you've stopped by, and we look forward to helping you get the tax information you need. If you are having any issues with a site or website content or have any help or questions you'd like to contact please see our Contact Us page. If you'd like to speak with an IRS agent, you can reach one by calling this “phone” at. If you need a paper copy of tax information, visit the IRS Taxpayer Assistance Center. They'll also provide guidance on Forms & Publications. The IRS believes that everyone, no matter what their income, should file and pay their taxes. We want to help you do just that- help you make the most of your tax dollars by working with you to prepare your tax returns and answer any questions you may have about your taxes. With our knowledgeable and courteous help, you are sure to receive the advice, assistance and support needed, no matter how big or small your tax return is. Our goal is to ensure individuals and businesses that file and pay their tax in a timely manner. We do this by working with individuals and businesses, and helping them to understand and meet tax requirements. We also provide guidance with Forms & Publications so that individuals know what to expect and how to file the necessary tax forms. As part of our commitment to helping individuals prepare their tax returns and pay their taxes efficiently and successfully, we've also offered our IRS Taxpayer Assistance Center (TAC) to provide helpful and informative advice during the IRS tax season on a variety of topics including tax filing deadlines, tips and tricks, filing tips, and more. If you require any further assistance, please feel free to contact our Taxpayer Assistance Center toll-free at. We will continue to improve our service and our knowledge of the laws and services the IRS provides. Thank you for your service, and we look forward to serving you.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete New Mexico Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a New Mexico Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your New Mexico Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your New Mexico Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.