Award-winning PDF software

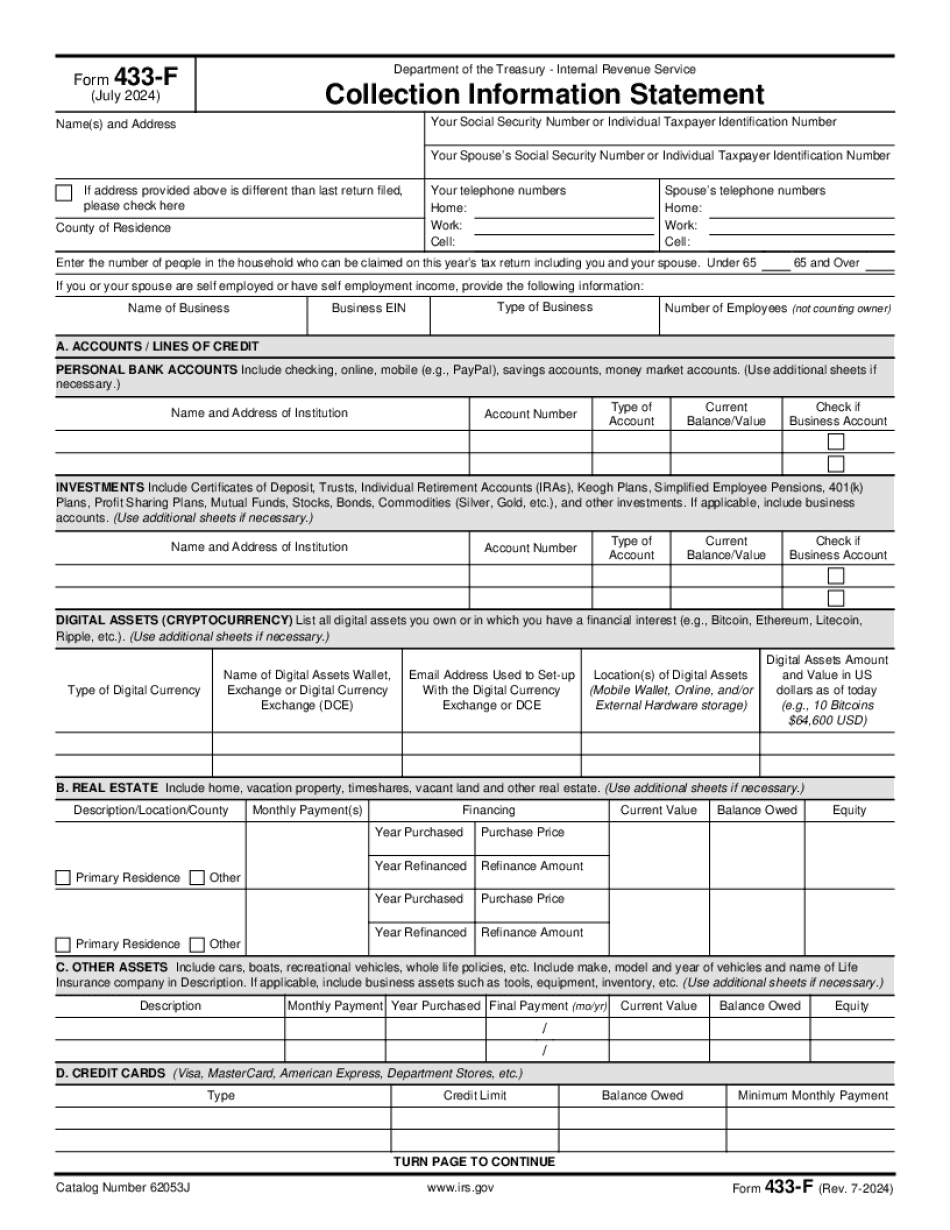

Thousand Oaks California online Form 433-F: What You Should Know

If you are struggling to pay or have a tax debt, the IRS offers many helpful resources to help. Here are the things you need to know about filing the IRS Form 433F (Collection Information Statement). What Form 433F does (and does not) collect. Form 433F helps the IRS determine your income to help you file any form or get a refund. Form 433F will not help you pay off a delinquent debt due to a tax debt, or help you get credit as opposed to a check. The following information is collected in order to determine whether you need to collect any federal tax debt: · Date of birth · Federal tax liability(s) This information is not included on paper Forms 433F, or forms or any other forms that may be used to gather your own information. The information is not disclosed to anyone. Form 433F will not assist you in negotiating a payment plan with the IRS. The information is only used to help the IRS better understand how your financial situation affects your ability to pay back taxes. If you can't pay your taxes, the IRS will consider you to be in 'hot water' and send a collection letter. What will happen to your information on Form 433F. Your information will be maintained in the FBI National Database of Criminal History. The information is maintained for seven (7) years from the date you file. The FBI retains it indefinitely. What is considered a debt for tax purposes. If you owe any amount, including back taxes, at any time for a tax year, your tax debt becomes current and will be assessed against you when any portion that falls due is due. The IRS will assess your tax debt on the date you timely pay and/or file, even if tax collection efforts are not commenced. This means, if you are not aware of a 3,000 tax debt, no collection efforts will be made. How does the IRS collect Form 433F. If you owe a tax debt, you can file Form 433F or submit a written request. Form 433F will be sent to you within a reasonable time. If you require further assistance contact the IRS Taxpayer Advocate Office (TPA). What is the current collection policy for the IRS? With the growth of electronic and internet based solutions, it is not realistic to expect the IRS to ensure timely processing of a collection.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Thousand Oaks California online Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a Thousand Oaks California online Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Thousand Oaks California online Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Thousand Oaks California online Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.