Award-winning PDF software

Iowa online Form 433-F: What You Should Know

IRS calls non-traditional taxpayers the new taxpayers…the people who don't file a normal tax return and instead file Forms 1040A and 1040EZ The IRS has released guidance to help taxpayers deal with the tax issues it expects to be a growing and complex practice. Here's how it did this. Mar 7, 2025 — Tax Tips for Filler Blog If you didn't receive your 2025 Form I-9 (if you're an LLC), you can request a paper I-9. The IRS will not hold that request against you. The best way to ensure that your tax return is not improperly withheld is to prepare and mail a paper Form 1040X. Here's The IRS' new tip for you: Mar 7, 2025 — IRS says new taxpayers should prepare Form 1040X (see IRS Publication 15-A and Publication 515 if you don't have 1040X). Payment Agreement for the One Percent — one percent tax blog June 24, 2025 — Payment of estimated tax is another one of those cases in which it's best to go into your monthly financial report first and prepare a simple payment plan with your accountant. Mar 8, 2025 — Tax Tips for One Percent Blog — fill out Schedule C or E Mar 8, 2025 — What did the IRS tell the government to do to deal with the surge of one percent taxpayers, Mar 4, 2025 — The IRS just released guidance on the payment of estimated taxes — pay your estimated taxes before you get a bill. Mar 8, 2025 — IRS Releases Guidance to All Taxpayers (Payment Plans and Filer Notices) The IRS today issued what are called Pay-or-Skip Payment Plans. The guidance says: If you've been assigned an Individual Master File number (IMF) that has a scheduled opening (SOL) in November for a certain type of tax return, the IRS now recommends that you file online beginning the first full month of November. You can set payments for your returns, and the IRS will pay them on your behalf. The Pay-or-Skip program (which will be available to taxpayers as long as they have an IMF number) has the potential to relieve taxpayers from waiting months for returns they haven't been assigned to receive payment of estimated tax. IRS.

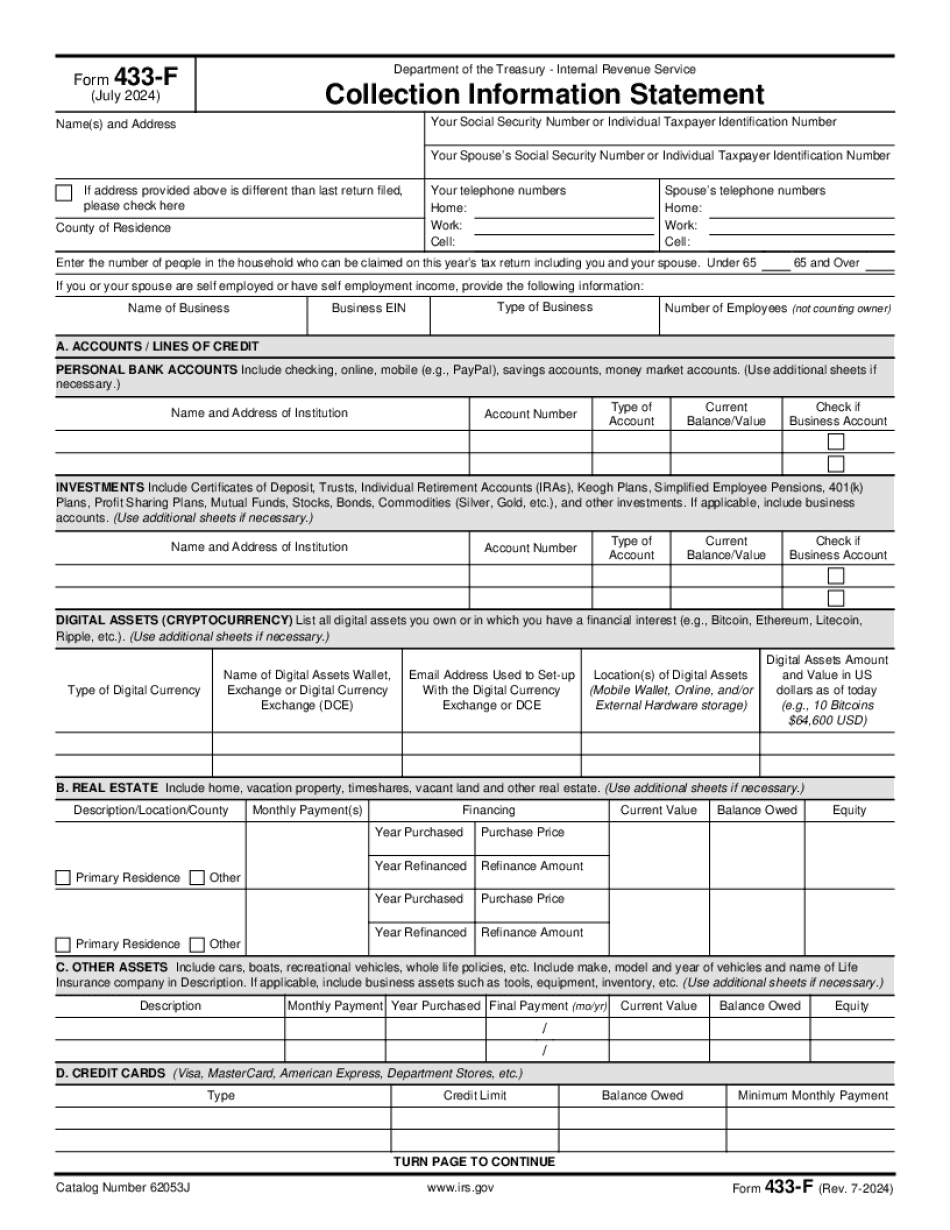

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Iowa online Form 433-F, keep away from glitches and furnish it inside a timely method:

How to complete a Iowa online Form 433-F?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Iowa online Form 433-F aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Iowa online Form 433-F from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.