My name is Mike Sullivan. Uh, I'm a former IRS agent. Uh, welcome to my YouTube channel. I worked for the IRS for over a decade. Me and my Eminem man, who's the power in me, the brain trust, um, want to tell you, talk to you today about the 433 433f financial statement. And as a former IRS agent, I want to give you special tips and things you need to be aware of when you're giving the IRS that form. I've looked over thousands of these forms. Uh, the 433a, which is a longer version, the 433b, which is the business version. So, what do you need to know about this form? Usually, it goes to the Atlanta Service Center. So, what are the service centers like? Well, there are different call centers. Uh, when you call the Internal Revenue Service, you call a 1-800 number. That's a switching station. It goes to any IRS kind of boiler room operation collection or whatever you're going to call them. There are just some giant offices, and whoever's there picks up. You can call two days and you'll get two different people all over the country, anyway, from California to Florida. Someone is just going to pick up, which division and uh, their staffing for that. These people are really trained to evaluate a 433f, and they're really looking at two things that you really need to know. The first is what assets do you have or what assets can you liquidate. And the second one is they're looking at your income to expense ratio. And here's where I give you the really big caution that you need to know about this. Most people are completely unaware that the IRS has what's called the national, local, and regional standard that...

Award-winning PDF software

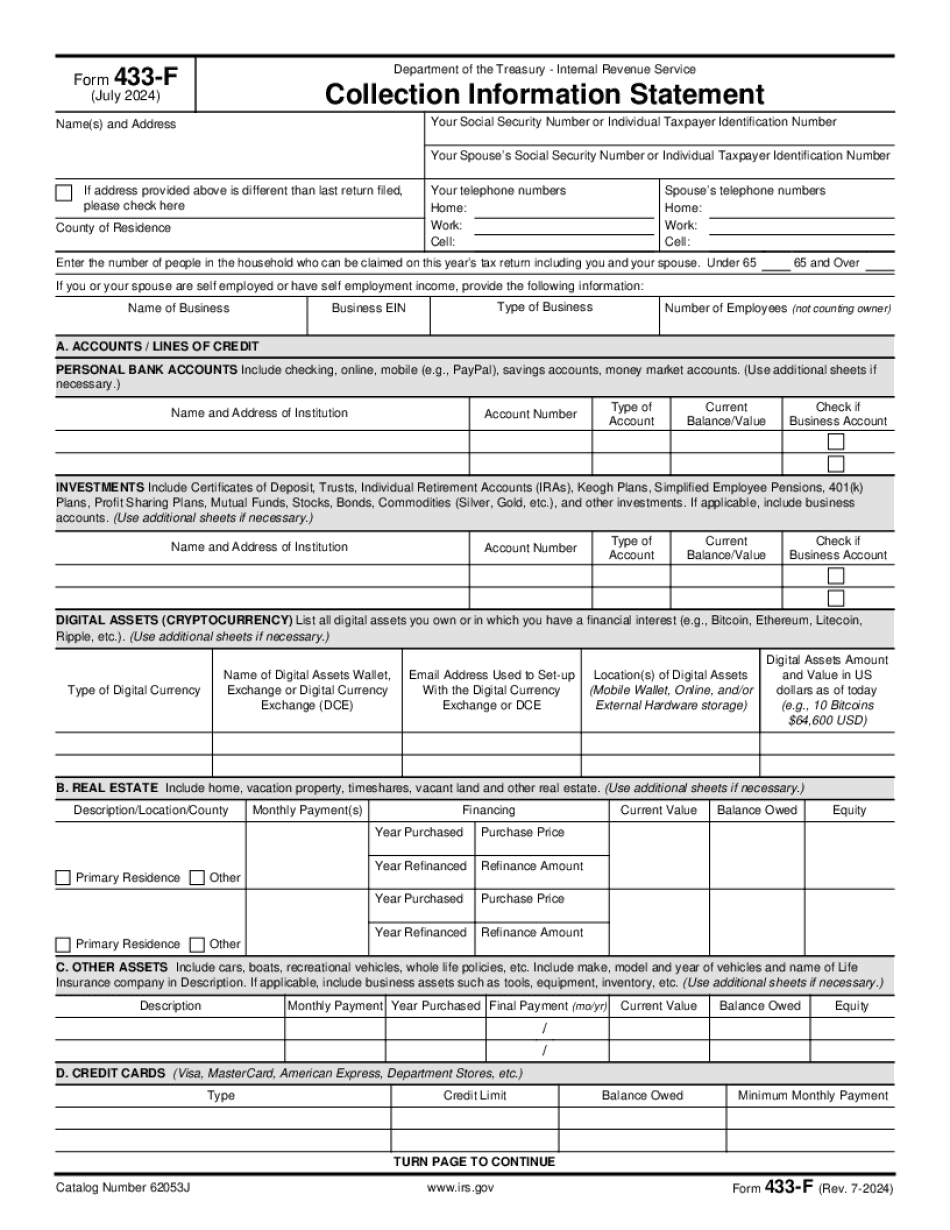

Video instructions and help with filling out and completing Form 433-F vs. Form 433d