Form 433-F for IRS Automated Collection Service 2024-2025

Show details

Hide details

Y. Your signature Spouse s signature Date Instructions for Form 433-F Collection Information Statement E1 List all Accounts Receivable owed to you or your business. Note You may be able to establish an Online Payment Agreement on the IRS web site. To apply online go to https //www.irs.gov click on I need to pay my taxes and select Installment Agreement under the heading What if I can t pay now If you are requesting an Installment Agreement you should submit Form 9465 Installment Agreement ...

4.5 satisfied · 46 votes

form-433f.com is not affiliated with IRS

Filling out Form 433-F online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form 433-F

Every person must report on their finances in a timely manner during tax season, providing information the IRS requires as precisely as possible. If you need to Form 433-F, our reliable and user-friendly service is here to help.

Follow the instructions below to Form 433-F quickly and accurately:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official guidelines (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Complete your template utilizing the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Take advantage of the Highlight option to accentuate specific details and Erase if something is not applicable any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or select Mail by USPS to request postal report delivery.

Opt for the best way to Form 433-F and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Irs Form 433 F?

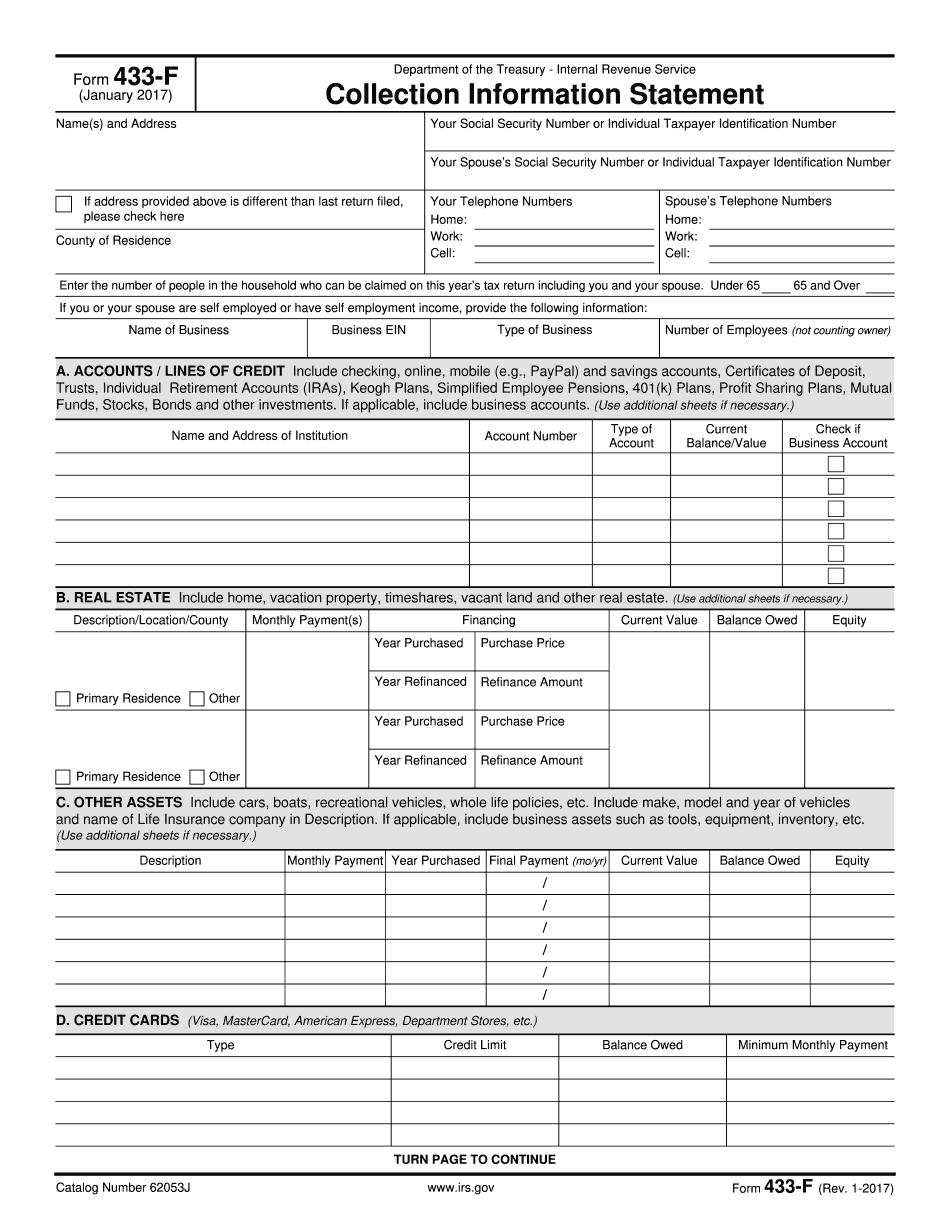

The form 433-F is also known as Collection Information Statement. It is usually used to collect financial data form the individuals with delinquent tax debt. If you owe the Internal Revenue Service money, you are provided with this document in order to determine how you can repay your arrears. Then IRS can define your eligibility for payment plans.

You may also use the form 433-F to apply for uncollectible status. The IRS doesnt make completing this document easy for you. However, you may facilitate the process by using online services with fillable templates. Read the following instruction to fill out the template correctly.

This paper is divided into 8 section, each of which requires your close attention. Look through the list of data to include:

- 01Your bank accounts and lines of credits, IRA, profit sharing plans, mutual funds, bonds, and related accounts;

- 02Any property you own including your primary residence, vacation homes, rental properties, and even timeshares (including the reason of purchasing, price, current value and equity);

- 03Details about other assets you own (cars, boats, RVs or whole life insurance)

- 04Business information;

- 05All your credit cards;

- 06Employment information (how much you get paid and what gets taken out for taxes)

- 07Additional earning (alimony, child support, unemployment payments);

- 08Amount you spend each month;

Note, that it is necessary to sign the document that is also possible to perform online.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 433-F?

As stated above, the purpose of Form 433-F is to make an independent assessment whether the IRS's information returns (IRS Form 5326e, Form 5327, and Form 5328) should be filed on an advance schedule, and the results of the assessment.

There is no formal IRS requirement that advance annual estimates be filed by taxpayers. However, taxpayers are advised to consult their tax professional about Form 433-F if there are substantial changes in their situation that may require an early filing.

Form 433-F may be filed without an advance estimate. Form 433-F is a return that describes the taxpayer's condition at the time of the filing of the return, and a taxpayer can file it when the taxpayer is well enough to do so.

If filed without an advance estimate, Form 433-F is required to indicate:

The date the return was filed

The date when Form 5326e, Form 5327, or Form 5328 should be filed

The purpose of these forms is to assist the taxpayer with the preparation of the return, not to assist the IRS in making a determination as to the timing of these records being filed, nor in the preparation of an information return.

When should Form 433-F be filed?

If tax returns are required to be filed on an advance schedule, Form 433-F should be filled out no later than seven days prior to the tax date that the return is intended to be filed. It's not necessary to file Form 433-F if the IRS has only informed you that it believes the returns are required to be filed on a particular date.

If there are substantial changes in the taxpayer's affairs that may require the filing on an advance schedule, Form 433-F should be filed no later than seven days before the date when the return is intended to be filed. However, in most cases, Form 433-F should not be filed more than 90 days before the tax return is supposed to be filed — even if the taxpayer may have filed one prior notice of assessment.

What happens if you do not file Form 433-F for a tax year at the time provided?

If a taxpayer is not filing Form 433-F at a time indicated by the IRS, the IRS will mail the taxpayer a Letter of Withholding and Refund showing the period for which the returns should be filed, and a Form 5768, Declaration of Tax Refusal to File Information Returns.

Who should complete Form 433-F?

All of these items that require a separate application must be submitted to the U.S.

When do I need to complete Form 433-F?

A Form 433-F is required in all cases of sexual abuse on a child 14 years or younger. If the form is missing, a report of suspected abuse may be received. The police officer who conducts the investigation will determine whether a police report may or may not be filed. In either scenario, the Department will then initiate the follow-up for a report of suspected sexual abuse. If, after completing the investigation, no police report is filed, the child's foster care placement agency will be notified as required by federal law. If, after completing the investigation, a report of suspected sexual abuse is not filed or if the case is closed with no further action, Form 433-F will be filed in accordance with the law.

I have a case and want to pursue a federal civil rights lawsuit. What could I possibly win?

A federal civil rights lawsuit may be filed if you have been injured as a result of alleged sexual abuse. The federal suit could be filed in any court of competent jurisdiction, not just federal court. You should consult a lawyer for legal advice and assistance. It is important to remember that you cannot sue other individuals in a court of law.

Does it matter if my foster child was abused while in my care?

Yes. A State Department investigation involving your foster child should always be followed by a State Department investigation that looks at the entire child protection history of your child.

Can someone write a cover sheet for me if I have an investigation in progress under section 5 of the federal Family Act?

No. A State Department investigation has to be completed by the investigating officer first. Once the investigation is completed, the cover sheet can be written by the investigating officer's supervisor or attorney who is not an officer. No person can draft or give you the Cover Sheet.

Can I do investigative work for the foster care system?

The Department's law enforcement officers should not be the only investigators. It is not within the Department's investigative function to investigate allegations of sexual abuse against foster care children. It should be handled internally. If there is a complaint that a foster child has been sexually abused, the local law enforcement officer should investigate. The local law enforcement officer will then be forwarded the information to the Department to investigate as the investigating officer is not the Department's investigator. If there is not a victim and the child claims to be the victim's parent, the Department's child protection investigator should be contacted.

Can I create my own Form 433-F?

As with any form, it is possible to create your own form. You will need to obtain an API Key before you can create your form.

How can I determine whether the API key is active?

See the FAQ for help identifying your API key.

What is a Custom HTTP Header?

A Custom HTTP Header is a special header that is automatically included on all API requests. Your server MUST set this header when receiving the request. All other headers are ignored. The default value for the Custom HTTP Header is set to “X-API-Header” without the “?” character.

How do I add Custom HTTP Header information?

See the FAQ for details, and the Custom HTTP Header sections in the Custom HTTP Header documentation for more information.

Why can't I get a User I'd and API Key for the server?

Make sure you have downloaded your Google Play Developer Console application and set up an API Project. See the Google Custom HTTP Header documentation for more information regarding setting up your own API project. If you are having difficulty getting the API key and User I'd, please contact your server administrator for assistance.

Why can't a client request more than one record in a single API request?

For any particular field (such as country and state), you can request up to 10,000 records. In general, you will rarely want to request more than 10,000 records for very common values such as country, state, or phone.

Do I have to be online to make a request?

Yes, the information you provide must be received and parsed by the server before your request can be processed.

My request is returning empty payload?

The server might be experiencing issues with parsing the response, or it might have been truncated. To check if your request is returning empty payload, you can use the HTTP Status Code parameter:

GET /account/create {“error”: “No such file!”, 401, 302}

I'm requesting an incomplete record. How can I get more info?

If your request was successful, you will receive an empty HTTP response. Otherwise, you will also receive a “Request error — server error” HTTP status code. The following code sample displays the status code returned:

HTTP/1.1 404 Not Found.

What should I do with Form 433-F when it’s complete?

If you received a Form 433-F on April 30, 2012, and you have not filed an amendment to that Form, we are required to file an amended return by April 30 of each year. The information that you provided on Form 433-F regarding the taxpayer's liability for federal income taxes on the transfer price of a stock option may have changed due to subsequent tax law developments. If this information changes, you should file both amended returns. The reason that we prefer (rather than require) the filing of an amended return is that we know how much it costs to file the amended return.

If you received a Form 433-F on April 30, 2012, and you are entitled to receive the benefit of the tax refund provided in tax regulations (Section 1021, 1022 or 1023 of the Internal Revenue Code) on the value of the transfer price of a stock option, you should include the value of the transfer price of a stock option in the taxable gross income of the transferor who is not entitled to a refund on the portion of the transfer price that was includible in income without a tax liability of the transferor.

If you did not receive a Form 433-F on April 30, 2012, we also may require the filer to file a return (with information reporting the transfer date and the applicable tax) in a manner similar to the return filing process in which you have filed. However, this return must be filed on or before April 30 of the applicable year or the transfer will be tax-free. We may also require the filer to report the transaction on a Form 1040 Tax Return or Form 1040X, which we will file with copies of such form to each of the parties listed on Form 433-F and the filer's tax preparer to whom the information was reported. If not, the tax refund will not be provided and the tax due will be due.

Q1. I received a Form 433-F from a party of the trade. What should I do with this tax return?

You may receive a copy of the Form 433-F from either the filer or from the party of the trade. If the party of the trade was eligible to file a Form 990, such form may have been issued to that tax filer or may have been returned unclaimed by the filer.

See IRM 21.5.1.9, Form 433A-W/C and IRM 21.5.

How do I get my Form 433-F?

You can find an application form from IRS Publication 926 (PDF) at IRS.gov/Forms.

What documents must I include with my Form 433-F? Your Form 433-F must contain all the following information: The mailing address where the return and payment were received by you.

The amount of return that was due.

The tax that applied to the return.

The information for the current tax year (or, if filed recently, the tax paid to date, if known, or the last tax year).

The information on the form to show the relationship between you and the taxpayer.

Important: You may not use the information that is shown on your Form 433-F. All other information is considered public information.

I received my Form 433-F earlier this year. What information was included in my return? In most cases, the information required on your Form 433-F was already published on IRS.gov. However, the information you need to provide may be published more than a year earlier, and the information may differ from the information published on IRS.gov. You can check IRS.gov periodically to see what information is available.

What if I filed my 2011 return after the deadline (i.e., during the 2012 tax year)? If a Form 433-F was due on any tax return that was not filed by the specified deadline for that year, you still must file it by the deadline. However, you should be patient, as IRS may revise the original Forms 433-F for your filing.

Where can I file my Form 433-F? You must file a tax return (Form 1024) that includes all the information on your Form 433-F in order for the IRS to accept it. You do not need to have an account number before you file. IRS recommends this because it makes it easier to track an account in case the IRS needs to call you (for example, if you owe taxes).

What documents do I need to attach to my Form 433-F?

Please provide any attachments for the information and documentation listed below. Please be sure to provide any required documentation on the document(s) you attach, as you submit your Form 433 for review and release.

An affidavit from a named individual (the applicant) or an officer or employee of the entity with which you are filing. This affidavit should be on a single sheet of paper and should clearly define the applicant's relationship and responsibilities, such as the person's position. Please include in your affidavit the name, address, title and year in which the corporation was incorporated or organized.

If a corporation was formed in Delaware, submit the following: Delaware corporation certificate of incorporation and a certificate of number and year of record filed with the city clerk's office of the city in which the corporation is registered or a certified copy of the charter. If a corporation was formed in any other state or country, submit a certificate of organization, if known; certified copy of the documents that establish corporate existence; copy of or a registered or certified copy of the articles of incorporation or articles of amendment (or, if the filing statement, an explanation in accordance with the requirements of Section 1-104 below); a statement that the entity is not engaged in the business of investing or dealing in new securities; a statement that the entity has a written policy regarding conflicts of interest and financial disclosure; a list of all persons by name, address and title (and number of shares of any class) holding over 5% of the voting power or 10% of the value of any class of stock or other securities (the entity may elect to disclose the names of a limited number of directors and the number of shares of each class); a statement that the entity and all directors and officers are not under criminal indictment and are not subject to civil investigative or judicial proceeding for a violation of the laws of the United States and a certified copy of the summonses, search warrants and other search warrants that may be issued in connection with the investigation or prosecution.

If the entity is a corporation organized outside the United States and is subject to U.S. jurisdiction in any state or country, submit (in addition to the information required in Section 2-103 in the Code of Federal Regulations): Any information on the incorporation of the entity, or of a predecessor thereof, if you believe that information to be applicable.

What are the different types of Form 433-F?

Below, you can find a chart that outlines the different types of Form 433-F filings that the IRS receives.

Form 433-F is filed when the taxpayer files a return, and it's required to be filed by the due date of the return for the tax year and the calendar year. To make things easier to distinguish between the tax year and calendar year, the IRS also breaks Form 433-F down into four types of forms.

The Form is a regular Form that contains detailed information about your business, which is why it's known as a “summary” form. The Form also may contain information about some other business that you're doing. This is why the Form is sometimes referred to as a “form.”

Is a regular Form that contains detailed information about your business, which is why it's known as a “summary” form. The Form also may contain information about some other business that you're doing. This is why the Form is sometimes referred to as a “form.” The Business Statement is typically filed with a Form 1120. Business statements are a part of each Form 433-F that detail the activities that you performed during the tax year.

Is typically filed with a Form 1120. Business statements are a part of each Form 433-F that detail the activities that you performed during the tax year. The Income Tax Return is generally filed under Part I of the Internal Revenue Code (I.R.C.), and it covers all the income you reported on your Form 1120.

Is generally filed under Part I of the Internal Revenue Code (I.R.C.), and it covers all the income you reported on your Form 1120. The Business Investment Income Statement is typically filed with Part I of I.R.C. to identify your business activities.

Is typically filed with Part I of I.R.C. to identify your business activities. The Certificate of Entitlement is a Form 4684 that's filed to report the net income that you received during the tax year.

So what should you do if you have an existing tax return that hasn't been completed yet? In the case of an existing tax return that isn't completed, you should make sure that you're filed it. You should also see if you can consolidate the business income with other existing business income for purposes of completing Form 433-F. The IRS will help to facilitate this process.

How many people fill out Form 433-F each year?

The number of federal employees who file Form 433-F is unknown, although it was estimated by the GAO to be between 10,000 and 20,000 in 2015. It is not available on Form 433-H.

The Form 433-H form can be used by individuals or by organizations in the U.S. A non-U.S. entity is considered a U.S. person under the tax law and must report income and taxes in the same way as people in the U.S. They do not receive a Form 433-F, though they may have one if they reside in the U.S.

How do I prepare and file Form 433-H?

Use a U.S. certified or certified for U.S. purpose form. The appropriate form for the U.S. can be found online at the following sites:

If you prepare the Form 433-H, the IRS will provide you with a self-certification notice about how to file the form. You must complete and submit a self-certification by using Form 433-H.

What are some other options if I believe I have a U.S. person?

You may file a new U.S. tax return with form 8872, or you may take some steps to avoid double tax on income that you are unable to prove a U.S.

Is there a due date for Form 433-F?

If Form 433-F is requested no later than 30 days after the date that the property was transferred, no response may be made.

When does the filing of Form 4337-E satisfy the requirement for filing Form 433-F?

If the Form 433-F is filed in accordance with the requirements described in this section and if the total amount of the transfer plus any interest that is paid or accrued with respect to the property (including any deficiency) does not exceed 50,000 for all the properties, then the filing of Form 4337-E and payment of any deficiency is not required. However, if the total amount of the transfer plus any interest that is paid or accrued with respect to the property (including any deficiency) exceeds 50,000 for any of the properties, then the filing of Form 433-E and the payment of any deficiency is required.

What if Form 433-F was filed in reliance on a certification from the Secretary of State?

If a filing of Form 433-F would be required unless Form 4337-E was filed and an affidavit was made under penalty of perjury, then Form 433-F must be accompanied by a certified copy of the certification.

What happens on Form 4337?

Upon the filing of Form 433-E, the taxpayer must furnish the following itemized statement of the tax due to the tax filing authority within 30 (thirty) days after the date of the filing:

The aggregate value of the transfer plus any interest, any surcharges and any offset, if any, for each transferor in the calendar year in which or after which the Form 433-E is filed.

What does the tax filing authority do with the amount due?

The IRS sends the tax due to the taxing authorities of the jurisdiction where the transferor or transferee is established and where the property is located so that the appropriate tax may be collected. Thereafter, the transferee pays that tax to the applicable taxing authority.

What happens when Form 4337-E is not timely filed or the form is returned to the IRS?

If Form 433-F is not timely filed, no return may be issued to the taxpayer and the form does not satisfy the requirement for the filing of Form 433-F. If Form 433-F cannot be filed for any reason, then the taxpayer is required to pay the tax due without filing a return.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here